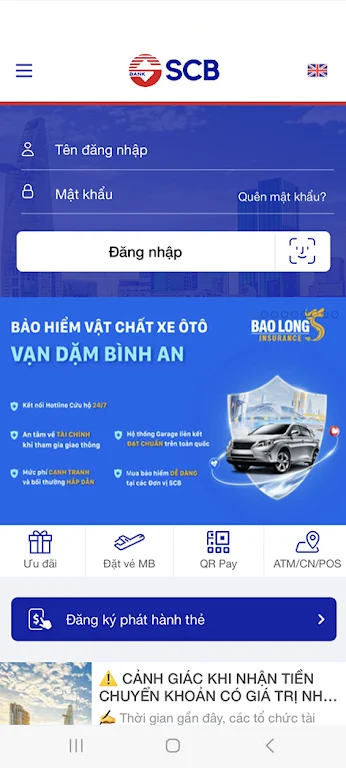

Introducing SCB Mobile Banking, the modern banking service designed for customers on the go. Developed by Sai Gon JS Commercial Bank (SCB) in collaboration with Vietnam Payment Solution JS Company (VNPAY), this user-friendly app allows you to conveniently conduct all your banking transactions from your mobile phone or tablet. With SCB Mobile Banking, you can easily check your balance, view transaction history, get exchange rates, find ATM locations, transfer funds, pay bills, purchase insurance, and even book airline tickets. Available on Android, iOS, and Windows Phone, this app is your one-stop solution for all your banking needs anytime, anywhere.

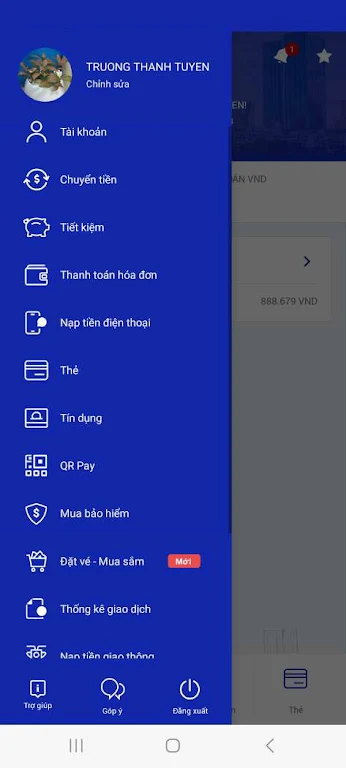

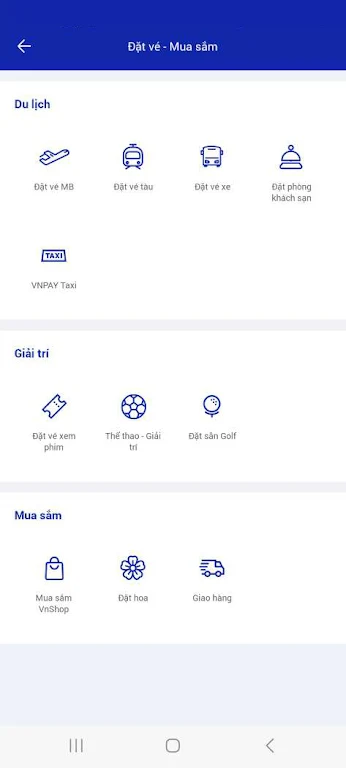

Features of SCB Mobile Banking:

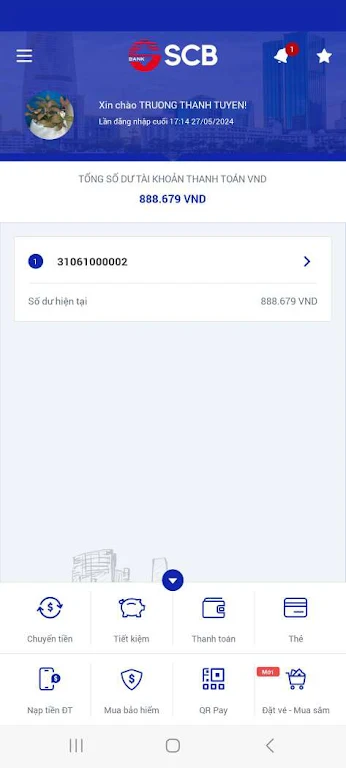

- Balance inquiry and account transaction history: With SCB Mobile Banking, customers can easily check their account balance and transaction history at any time. This provides users with a quick overview of their finances, helping them stay on top of their spending and budgeting.

- Exchange rate, interest rate, and gold price inquiry: The app also provides real-time information on exchange rates, interest rates, and gold prices. This functionality is extremely useful for customers who engage in foreign currency transactions or investments, as it allows them to make informed decisions based on the latest market updates.

- ATM and branches lookup: SCB Mobile Banking comes with a convenient feature that allows users to locate the nearest ATM or branch of Sai Gon JS Commercial Bank. This saves customers time and effort by providing them with easy access to essential banking services.

- Internal and domestic fund transfers: The application enables customers to transfer funds between their own accounts within SCB or to other accounts within Vietnam. This feature is a convenient way to make payments, settle bills, and send money to friends and family.

Playing Tips for SCB Mobile Banking:

- Familiarize yourself with the app's layout: Take some time to explore the different menus and sections of SCB Mobile Banking. This will help you navigate the app more efficiently and make use of all its features.

- Set up notifications and alerts: Opting to receive notifications and alerts from the app can help you stay informed about important account updates, such as deposits, withdrawals, or low balances. This will allow you to take immediate action if necessary.

- Use the exchange rate and interest rate inquiry feature for informed decisions: Before making any foreign currency transactions or investment decisions, check the app's exchange rate and interest rate inquiry section. This will ensure that you have the most up-to-date information to guide your financial choices.

Conclusion:

SCB Mobile Banking is a user-friendly and convenient application that brings modern banking services to customers' fingertips. With features such as balance inquiry, account transaction history, and real-time exchange rate information, users can easily manage their finances and make informed decisions. The app's ATM and branches lookup feature provides quick access to essential banking services, while the internal and domestic fund transfer capability allows customers to conveniently make payments and send money. By utilizing SCB Mobile Banking, users can conduct banking activities easily, conveniently, and with peace of mind, knowing that their financial needs are just a few taps away.