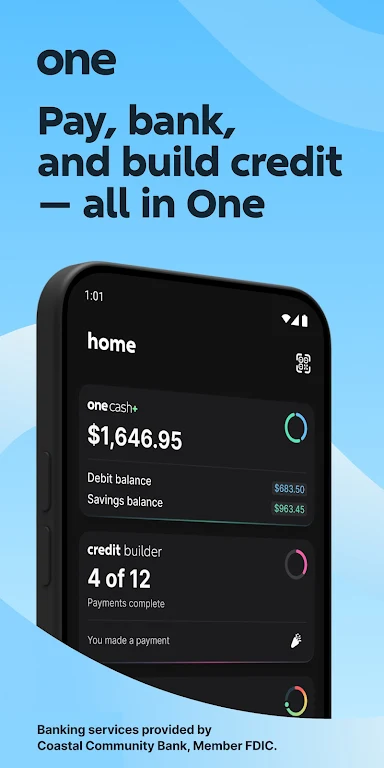

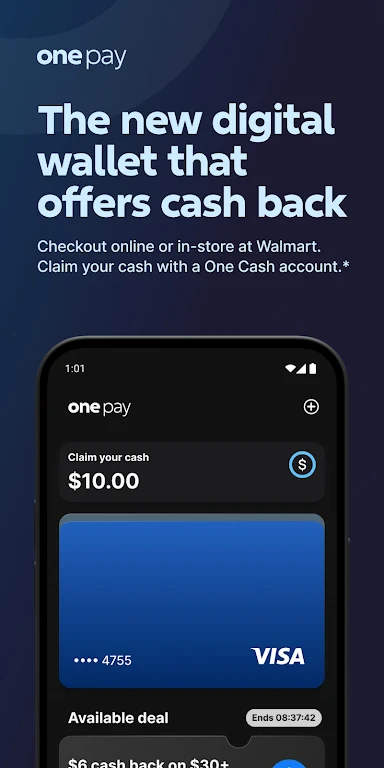

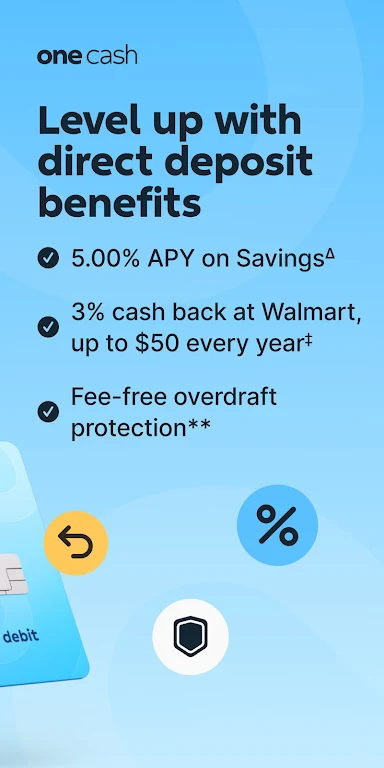

One - Mobile Banking is a convenient and innovative mobile banking app that offers a wide range of financial services to its millions of customers. With One, you can enjoy features such as Debit Rewards, early pay, and high-yield Savings. One also stands out by offering up to 5% cash back on select brands through its One Rewards Program. Plus, with eligible deposits, you can earn 3% cash back at Walmart, up to $50 every year. The app also allows you to easily send money to anyone in seconds through its One to One feature. And if you're looking to grow your savings, One offers an impressive 5.00% APY on eligible deposits up to $250,000. With its user-friendly interface and numerous benefits, One is revolutionizing the way we bank. Experience the future of banking and join One today.

Features of One - Mobile Banking:

❤ Mobile Banking Convenience:

One offers the convenience of mobile banking, allowing users to access their accounts and manage their finances anytime, anywhere. With the One app, users can easily check their account balance, view transaction history, transfer funds, and even deposit checks right from their mobile devices.

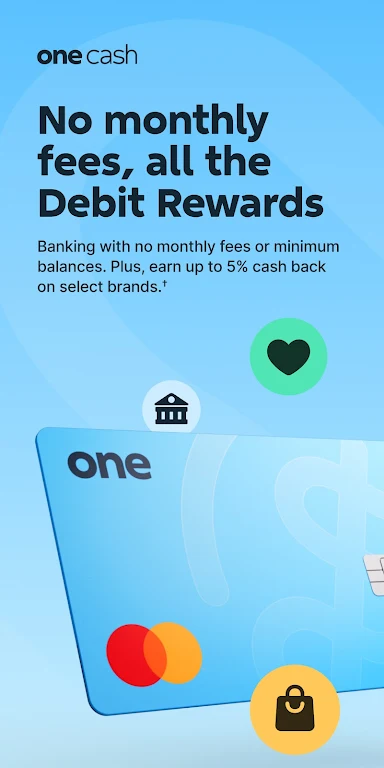

❤ Debit Rewards:

One's Debit Rewards Program allows users to earn up to 5% cash back on select brands. By simply using their One card for eligible purchases, users can accumulate cash back rewards that can be redeemed for future purchases or deposited directly into their account.

❤ Early Pay:

One offers the perk of early pay, allowing users to receive their paycheck up to 2 days in advance with direct deposit. This feature is particularly beneficial for those who need access to their funds as soon as possible, eliminating the wait for payday.

❤ High-Yield Savings:

With One, users can earn an impressive ❤ 00% annual percentage yield (APY) on their savings balances, up to $❤ ❤ Additionally, users can receive a ❤ 00% APY on the rest of their savings balances. This feature allows users to optimize their savings and potentially earn higher returns compared to traditional savings accounts.

Playing Tips:

❤ Maximize Cash Back:

To make the most of One's Debit Rewards Program, users should take advantage of the select brands that offer 5% cash back. By regularly checking the One app for individual offer requirements, users can ensure they are making eligible purchases and earning cash back on their everyday spending.

❤ Set Up Direct Deposit:

To benefit from the early pay feature, users should consider setting up direct deposit with their employer. By doing so, they can receive their paycheck up to 2 days earlier, giving them more financial flexibility and the ability to cover expenses or save for their future goals.

❤ Maintain Eligibility for High-Yield Savings:

In order to earn a ❤ 00% APY on their savings balances, users should make sure they meet the requirements set by One. This includes either receiving $500 or more of eligible direct deposits in the previous month or maintaining a total daily account balance of $❤ 000 or more. By meeting these requirements, users can maximize their savings and earn higher returns.

Conclusion:

One - Mobile Banking is a financial technology company that offers a range of attractive features and benefits to its users. With the convenience of mobile banking, users can easily manage their finances on the go. The Debit Rewards Program allows users to earn up to 5% cash back on select brands, providing an additional incentive for using their One card. The ability to receive early pay with direct deposit offers users more financial flexibility and faster access to their funds. Additionally, the high-yield savings feature allows users to potentially earn higher returns on their savings balances. Overall, One is a comprehensive financial solution that offers convenience, rewards, and higher interest rates to optimize users' banking experience.