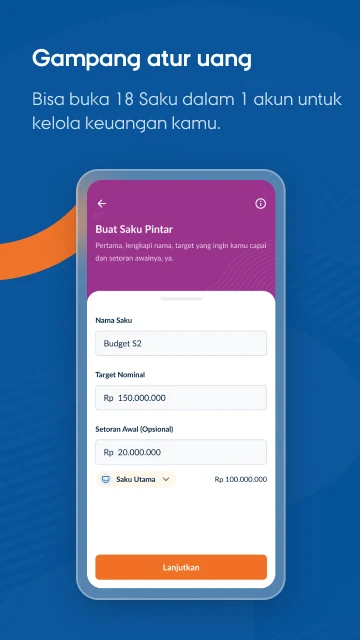

Introducing Raya, the digital banking app that will revolutionize your financial life and add some fun along the way! With Raya, managing your money has never been easier. Say goodbye to minimum balance requirements and annoying admin fees. Open a savings account anytime, right from your phone, without even stepping foot in a branch. And with competitive interest rates, watch your savings grow effortlessly. But that's not all, with Raya's pocket feature, you can easily divide your money into 18 different pockets to suit your needs. With secure access through fingerprint or face scan, rest assured your finances are in safe hands. So why wait? Join Raya now and let's celebrate the joy of simplified finances! #Celebrate

Features of Raya - Digital Bank:

- Easy savings: Raya allows you to open a savings account at any time without the need to visit a branch or go through a video call. Plus, there is no minimum balance requirement or penalty, making it hassle-free and convenient.

- Pocket management: With Raya, you can open 18 Pockets within a single account, allowing you to separate your money as needed. This feature makes it easy to allocate funds for different purposes and helps you better manage your finances.

- Easy and secure access: Raya offers smart login options, including fast and secure fingerprint or face scan. Additionally, it provides double protection with a password and PIN, along with session time and access restrictions to ensure the safety of your personal information.

- Competitive interest rates: By utilizing Raya, you can earn more money through competitive interest rates. This allows your savings to grow faster and enhances the profitability of your financial decisions.

Playing tips:

- Take advantage of multiple Pockets: Use the Pocket management feature to separate your funds for specific goals or expenses. This can help you stay organized and track your progress towards different financial objectives.

- Monitor transactions regularly: Keep an eye on your transactions through the Raya application. Regularly checking your account activity will allow you to identify any unauthorized charges or errors, ensuring the security of your finances.

- Optimize interest earnings: Maximize the benefits of competitive interest rates offered by Raya by keeping your savings in the account. The longer your money stays in the account, the more it will grow, helping you achieve your financial goals faster.

Conclusion:

With Raya - Digital Bank, managing your finances becomes easier and more enjoyable. The app's features, such as easy savings, pocket management, easy and secure access, and competitive interest rates, provide convenience and benefits for users. By following the playing tips, such as utilizing multiple Pockets, monitoring transactions, and optimizing interest earnings, you can make the most out of the app and effectively manage your financial life. Join Raya - Digital Bank now and celebrate the ease of managing your finances!