With the KLP Mobilbank app, you can take control of your finances wherever you are. Say goodbye to the stress of constantly wondering how much money you have left before your next paycheck. This app gives you a quick and easy way to check your balance and track your expenses. Not only can you transfer money and make payments, but you can also approve eFaktura and stay updated on the due list and latest transactions. Plus, you'll receive helpful notifications about new eInvoices, stopped payments, and messages from the bank. Activate the app with your unique 4-digit code or even use your phone's fingerprint reading for added security. Stay on top of your finances with the KLP Mobilbank app.

Features of KLP Mobilbank:

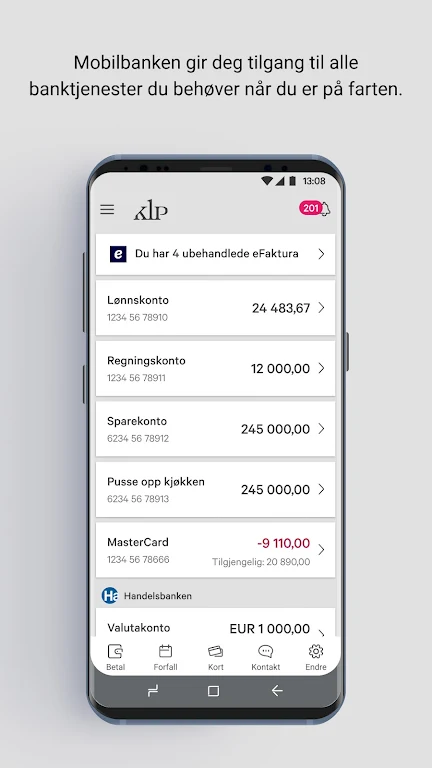

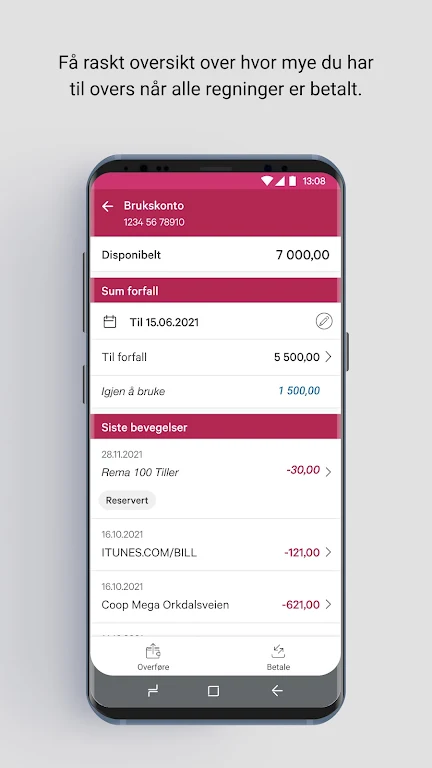

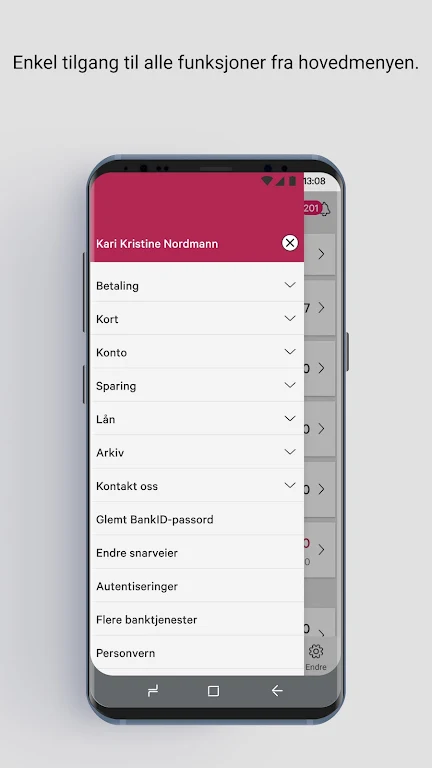

Quick access to online banking services: The KLP Mobilbank app provides users with the same services available in the online bank. This includes checking balances, transferring money, making payments, approving eFaktura, and checking the due list and latest movements.

Notifications and tailored information: Users will receive notifications about important updates such as new eInvoices, stopped payments, and messages from the bank. The app also provides personalized tips and information tailored to each individual user.

Overview of finances on the go: With the KLP Mobilbank app, users can easily get an overview of their finances while on the go. This allows them to check their balance and see how much they have left before their next salary.

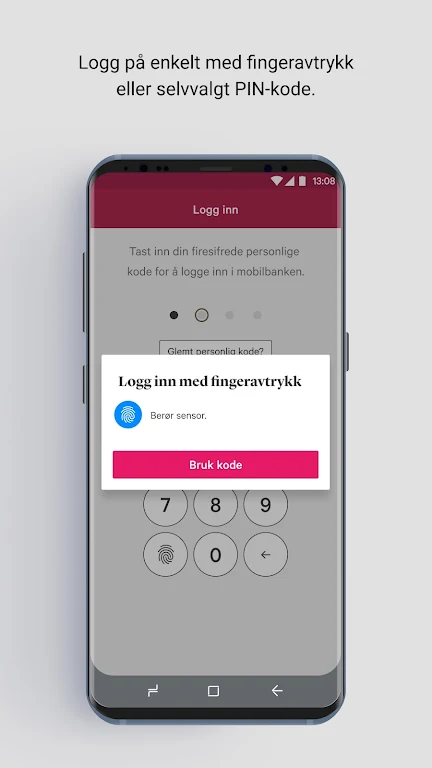

Secure login and payment options: To activate the mobile bank, users have multiple secure identification options such as BankID, BankID on mobile, or a code chip from KLP Banken. They can also choose to use fingerprint reading if their phone supports it.

Playing Tips for KLP Mobilbank:

Set a different code: When activating the mobile bank, it is recommended to create a different 4-digit code than the one used to unlock the phone. This adds an extra layer of security to the login and payment process.

Use fingerprint reading: If your phone supports fingerprint reading, consider using it as an alternative to the 4-digit code. This can make the login process quicker and more convenient while maintaining security.

Regularly check notifications: Make sure to regularly check the notifications from the app for important updates and messages from the bank. This will help you stay informed about any new eInvoices, stopped payments, or other relevant information.

Conclusion:

The KLP Mobilbank app offers a convenient and secure way for users to manage their finances on the go. With quick access to online banking services, users can easily check their balance, transfer money, make payments, and more. The app's notifications and tailored information ensure that users stay updated with important updates and messages from the bank. By activating the mobile bank and utilizing the playing tips such as setting a different code and using fingerprint reading, users can maximize the security and convenience of the app. Download the KLP Mobilbank app today and take control of your finances wherever you are.