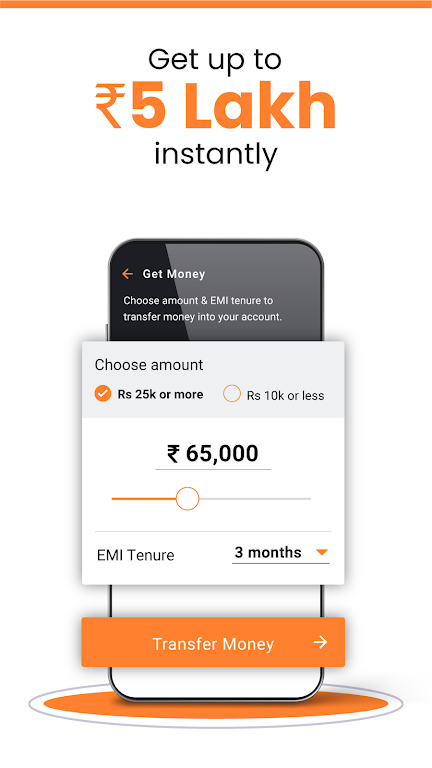

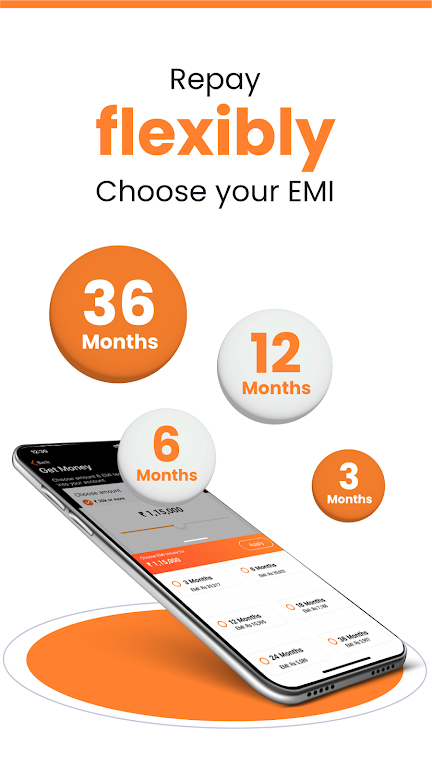

MoneyTap - Credit Cards & Loan is the ultimate solution for anyone in need of instant personal loans in India. With this app, you can get quick approval for credit up to ₹5,00,000 and only pay interest on the amount you actually withdraw from your balance. The best part? Our interest rates start from as low as 12%. This app is exclusively for salaried employees with a minimum salary of ₹30,000 per month. We understand the need for flexibility, so you can use this credit as an early salary. MoneyTap - Credit Cards & Loan offers a fully digital, paperless experience, allowing you to borrow any amount from ₹3,000 to ₹5 lakh and pay interest only on what you use. You can also choose your own flexible EMIs and pay later. Our loan terms and fees are transparent, with interest rates ranging from 12% to 36% per annum, APR from 10% to 70%, EMI tenures from 3 to 36 months, and low processing fees from 0% to 7%. For a better understanding, if you borrow ₹1,00,000 for a year with an interest rate of 13% per annum, you would pay a processing fee of ₹2,360, setup fee of ₹1,181 upfront, interest of ₹7,181, and an EMI of ₹8,932, making the total amount to pay ₹1,10,725. Rest assured, our interest rates vary based on your risk profile, and only a fraction of our customers get a rate higher than 30% per annum. The documents required for this app are Aadhaar number, identity proof, address proof, and a passport-sized photo or selfie. With MoneyTap - Credit Cards & Loan, you can conveniently get a personal loan online using your Aadhaar card.

Features of MoneyTap - Credit Cards & Loan:

> Borrow any amount from your approved Credit Limit: MoneyTap - Credit Cards & Loan allows you to borrow any amount or sum of money starting at ₹>000 from your approved Credit Limit, which can go up to ₹5 lakh. This gives you the flexibility to borrow the exact amount you need.

> Pay interest only on the amount you use: Unlike traditional loans where you pay interest on the entire amount borrowed, with MoneyTap - Credit Cards & Loan you only pay interest on the amount you actually use. This helps you save money by avoiding unnecessary interest charges.

> Instant personal loan without any risk: MoneyTap - Credit Cards & Loan offers instant approval for credit up to ₹5 lakh. This means you can get the money you need quickly and use it for any purpose without any risk.

> Fully digital, paperless experience: With MoneyTap - Credit Cards & Loan, you can apply for a personal loan completely online without the hassle of paperwork. The application process is simple and convenient, making it easy for you to get the funds you need.

Playing tips for MoneyTap - Credit Cards & Loan:

> Determine your credit needs: Before applying for a personal loan with MoneyTap - Credit Cards & Loan, assess your financial situation and determine the amount of credit you actually need. This way, you can borrow responsibly and avoid unnecessary debt.

> Choose your flexible EMIs wisely: MoneyTap - Credit Cards & Loan allows you to select your flexible EMIs and pay them later. Take the time to calculate and choose an EMI option that fits within your budget and repayment capabilities to avoid putting yourself in a financial strain.

> Pay attention to interest rates: MoneyTap - Credit Cards & Loan offers interest rates starting from as low as 12%. However, it's important to note that interest rates may vary based on your risk profile. Make sure to review and compare the interest rates before finalizing your loan to ensure you're getting the best deal.

Conclusion:

MoneyTap - Credit Cards & Loan is the best instant personal loan app in India for its unique features and benefits. With the ability to borrow any amount, pay interest only on the amount you use, and enjoy a fully digital experience, MoneyTap - Credit Cards & Loan offers a convenient solution for those in need of quick funds. By following the playing tips of determining your credit needs, choosing flexible EMIs wisely, and paying attention to interest rates, you can make the most out of your MoneyTap - Credit Cards & Loan personal loan experience. Download MoneyTap - Credit Cards & Loan today and enjoy the flexibility and convenience it offers.