Bangkok Bank Mobile Banking is a user-friendly and convenient way to manage your banking transactions. With this app, you have access to a range of features including viewing all types of deposits, credit cards, mutual funds, government bonds, and loan accounts. You can also request account statements, open an e-Savings account, and make cardless withdrawals at various locations. Additionally, you can conveniently invest in mutual funds, buy government bonds, make loan payments, and even make international funds transfers. The app also allows you to apply for additional banking services and manage your accounts with ease. With its secure and easy-to-use interface, Bangkok Bank Mobile Banking is the ideal solution for all your banking needs.

Features of Bangkok Bank Mobile Banking:

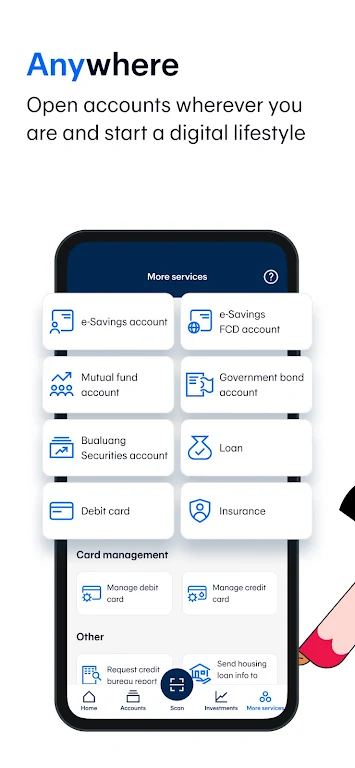

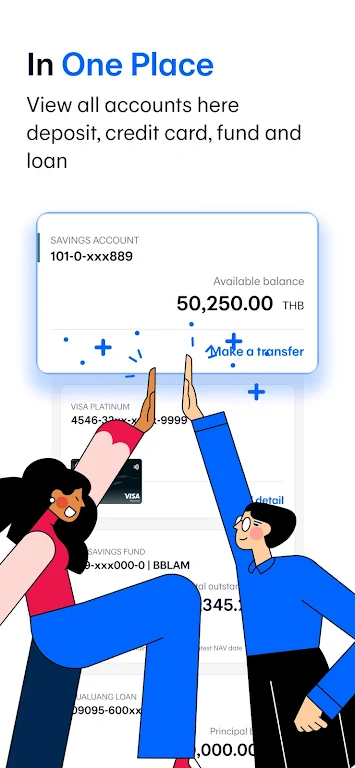

⭐ Comprehensive Account Access: With the Bangkok Bank Mobile Banking, you can conveniently access and manage various types of accounts including deposits, credit cards, mutual funds, government bonds, and Bualuang loan accounts. This means you can keep track of your finances all in one place.

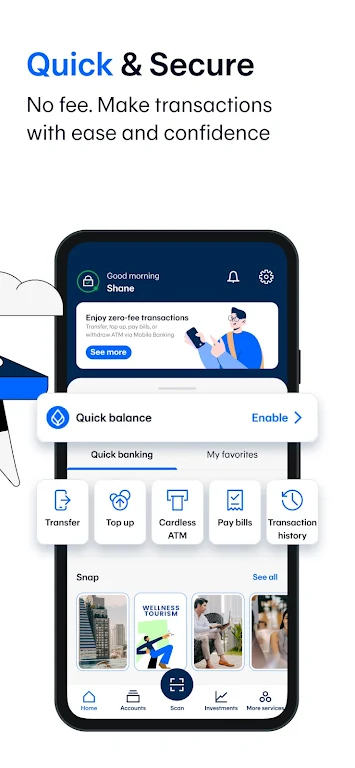

⭐ Cardless Withdrawals: Say goodbye to carrying your debit card everywhere. The app allows you to make cardless withdrawals at Bualuang ATMs, 7-Elevens, and Thailand Post offices, providing you with hassle-free access to your funds.

⭐ Investment Opportunities: The app offers a range of investment options such as mutual funds and government bonds. You can open a mutual fund or government bonds account, make payments, buy, sell, and switch mutual funds, and even buy government bonds on the secondary market.

⭐ Convenient Banking Services: Manage various banking services through the app, including requesting debit card activation, opening a Securities Trading Account, subscribing to Dollar Cost Average (DCA) service, registering for direct debit, and more.

Playing Tips for Bangkok Bank Mobile Banking:

⭐ Take Advantage of Mutual Fund Investments: This app makes it easy to invest in mutual funds. Consider diversifying your investment portfolio by exploring different funds and utilizing the app's features to buy, sell, and switch funds conveniently.

⭐ Set Up Cardless Withdrawal Preferences: To make your banking experience more seamless, set up your preferences for cardless withdrawals. This way, you can easily withdraw cash without needing your physical debit card.

⭐ Stay Updated on Investment Opportunities: The app provides access to investment opportunities like IPO periods for mutual funds. Keep an eye on the app to ensure you don't miss out on new fund offerings or attractive investment options.

Conclusion:

The Bangkok Bank Mobile Banking offers a range of attractive features that make banking more convenient and accessible. From comprehensive account access to cardless withdrawals and investment opportunities, the app caters to various financial needs. Furthermore, it provides a seamless user experience with additional services like insurance purchases and top-ups for LINE Pay. By utilizing the app's features and following the provided playing tips, users can maximize their banking experience, making it easier than ever to stay on top of their finances. Download the app today to enjoy the convenience of mobile banking with Bangkok Bank. (Word count: 100)