Introducing the PropertyX Malaysia Home Loan Calculator - the ultimate tool for anyone looking to buy property in Malaysia. This app is packed with features that make it the most comprehensive loan calculator on the market. It not only helps you calculate your loan amount, but also factors in additional costs such as entry costs, legal fees, and stamp duty. With the ability to simulate your loan in a graph, you can easily see how extra payments or one-off payments can save you money in interest. Whether you're a first-time buyer or looking to refinance, this app has got you covered. Get instant results and make informed decisions about your property purchase with the PropertyX Malaysia Home Loan Calculator.

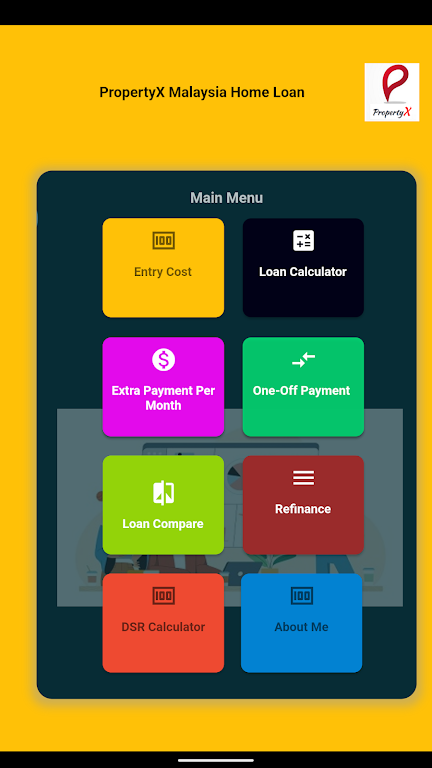

Features of PropertyX Malaysia Home Loan:

Comprehensive Loan Calculator:

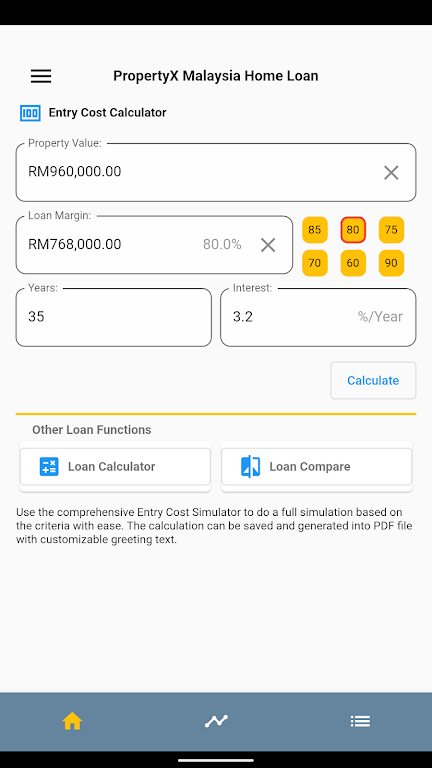

The Property X Malaysia Home Loan Calculator stands out as the most comprehensive loan calculator available. It provides a range of calculations including the Entry Cost calculator, loan calculator, loan comparison, extra payment per month, and one-off payment per month. With this app, you can accurately estimate your monthly payments and determine your loan affordability.

DSR and Loan Eligibility:

Understanding your Debt Service Ratio (DSR) and loan eligibility is crucial when applying for a home loan. This app simplifies the process by providing a user-friendly interface where you can input your financial information and receive an instant calculation of your loan eligibility. This feature eliminates guesswork and ensures that you are well-informed before approaching lenders.

Comprehensive Presentation:

The Property X Malaysia Home Loan Calculator offers a comprehensive presentation of the costs involved in buying a property in Malaysia. It includes calculations for MOT and Stamp Duty, lawyer fees, and valuation fees. By providing this holistic overview, the app ensures that you are aware of all the expenses associated with your property purchase, enabling you to make informed decisions.

Loan Simulator:

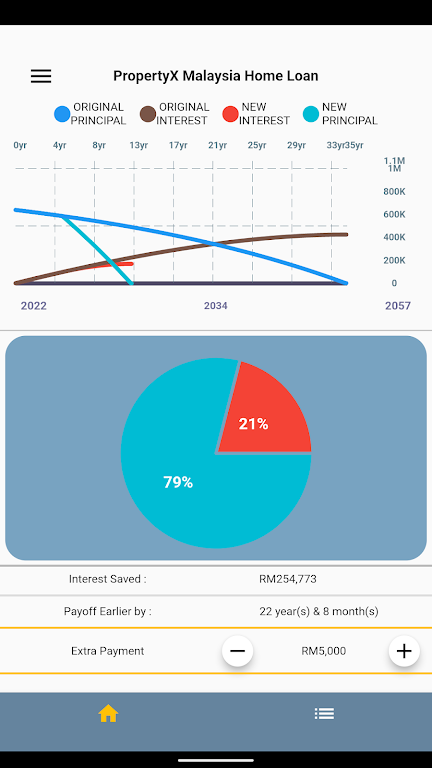

With the loan simulator feature, you can visualize your loan repayment journey in an easily understandable graph. This allows you to see the impact of different loan terms, interest rates, and repayment options on your monthly payments and overall loan amount. This visualization empowers you to select the loan option that suits your financial goals and capabilities.

Playing Tips for PropertyX Malaysia Home Loan:

Optimize Loan Repayment:

Use the extra payment per month and one-off payment per month features to see how making additional payments can significantly reduce both your interest and loan tenure. Experiment with different scenarios to find the sweet spot that fits your budget and helps you save on interest payments in the long run.

Compare Loan Options:

Take advantage of the loan comparison feature to assess various loan options available to you. Compare interest rates, loan terms, and repayment flexibility to find the loan that offers the most favorable terms for your specific needs.

Plan for Entry Costs:

Utilize the Entry Cost calculator to estimate the upfront costs involved in purchasing a property. This will help you budget effectively and ensure you have adequate funds for expenses such as down payments, legal fees, and valuation fees.

Conclusion:

The Property X Malaysia Home Loan Calculator is an essential tool for anyone planning to purchase a property in Malaysia. By offering a range of features such as comprehensive loan calculations, loan eligibility assessments, and cost estimations, this app empowers users to make informed decisions throughout the home buying process. With its user-friendly interface and interactive loan simulator, it maximizes convenience and ease-of-use for both first-time buyers and experienced investors. Don't miss out on this comprehensive tool that ensures you have a clear understanding of the costs and options associated with your property purchase. Download the Property X Malaysia Home Loan Calculator now and embark on your property ownership journey with confidence.