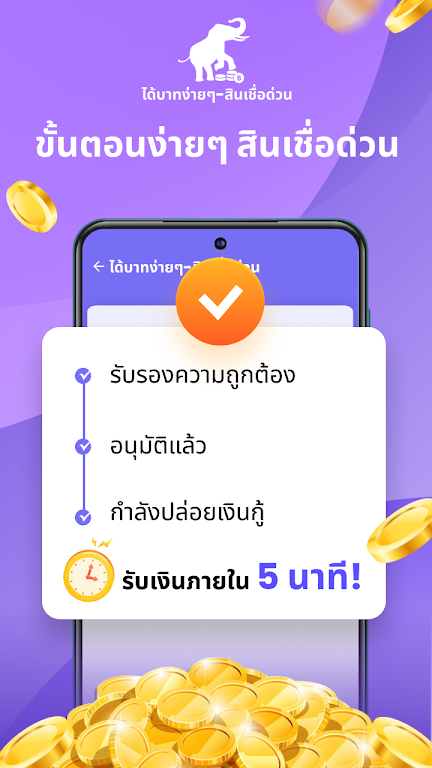

Introducing "กู้ให้ดีๆ - เงินกู้ดอกเบี้ยต่ำ," a top-notch app that offers a seamless and convenient online personal loan experience. Whether you need a small or large sum of money, this app has got you covered with its wide range of loan products and formats. But what sets it apart is its real-time comparison feature that allows you to compare different credit products easily. With Good Lending, you can borrow any amount between 1,000 and 20,000 baht, with a minimum loan term of 91 days and a maximum of 365 days. And the best part? The annual interest rate is capped at a low 14%, making it highly affordable. What's more, the app has a user-friendly interface that demonstrates exactly how the loan works. For instance, if you borrowed 10,000 baht for 120 days, your monthly repayment would be 2,620 baht, including all expenses. Once you meet the straightforward criteria—be 20 years or older, have a valid ID, and be a resident of Thailand—you're ready to dive into the world of hassle-free loans with Good Lending.

Features of กู้ให้ดีๆ - เงินกู้ดอกเบี้ยต่ำ:

⭐ 100% Online Personal Loan: Good Lending offers a convenient and hassle-free loan application process that can be completed entirely online. This means no lengthy paperwork or waiting in line at a bank, making it quick and easy to get the funds you need.

⭐ Wide Variety of Loan Products: Good Lending provides a range of loan options to suit different needs and financial situations. Whether you need a small loan for a short-term expense or a larger loan for a longer-term investment, they have a solution for you.

⭐ Real-Time Comparison: Good Lending offers a reference for real-time comparison of credit products. This means you can easily compare different loan options and choose the one that best fits your needs and preferences.

⭐ Low Interest Rates: Good Lending is committed to providing loan users with low interest rates in Thai Baht. This allows you to borrow money at affordable rates and save on interest expenses.

Tips for Users:

⭐ Determine Your Needs: Before applying for a loan, assess your financial situation and determine how much money you need and for how long. This will help you choose the right loan product with the appropriate loan amount and term.

⭐ Compare Loan Products: Take advantage of Good Lending's real-time comparison feature to compare different loan products. Consider factors such as interest rates, loan amounts, and repayment terms to find the best option for you.

⭐ Read the Fine Print: Before finalizing your loan application, make sure to read and understand the terms and conditions, including any additional fees or charges. This will help you avoid any surprises and ensure you are fully informed about the loan agreement.

Conclusion:

กู้ให้ดีๆ - เงินกู้ดอกเบี้ยต่ำ is a leading personal loan service provider that offers a range of attractive features. With a 100% online application process, a wide variety of loan products, real-time comparison tools, and low interest rates, they provide users with a convenient and affordable borrowing experience. Whether you need a small loan for a short-term expense or a larger loan for a longer-term investment, Good Lending has the solution for you. With their user-friendly platform and transparent terms, you can confidently apply for a loan and meet your financial needs. Experience the benefits of Good Lending's services today!