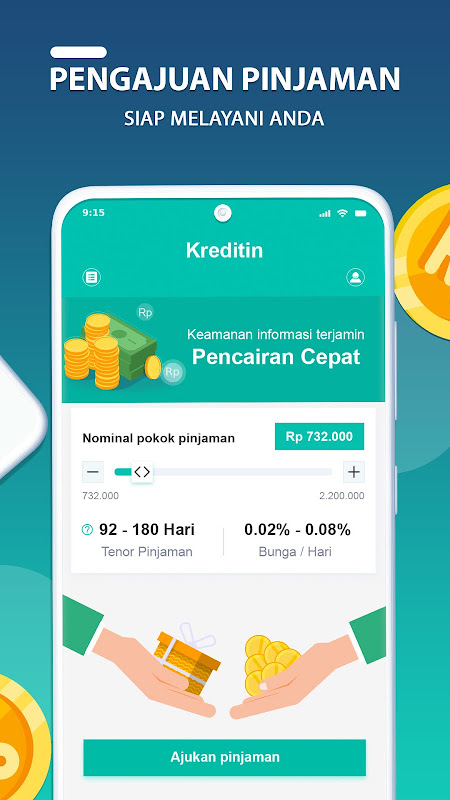

If you're looking for a quick and secure loan without the hassle of collateral, look no further than Kreditin - pinjaman tanpa agunan. With just a few simple steps, you can apply for a loan ranging from IDR 700,000 to IDR 7,000,000. Our user-friendly online platform ensures the safety and confidentiality of your personal information throughout the entire loan process. To be eligible for a loan, you must be an Indonesian citizen between the ages of 18 and 55 and have a stable source of income. Download the Kreditin app, register, fill in the necessary information, and submit your loan application. It's that easy!

Features of Kreditin - pinjaman tanpa agunan:

* Fast and Easy Loan Process: Kreditin offers a quick and simple loan process, allowing users to apply for loans ranging from IDR 700,000 to IDR 7,000,000. The application is designed to be user-friendly, ensuring a hassle-free experience for borrowers.

* Security and Privacy: Kreditin prioritizes the security of users' personal data. The platform utilizes advanced encryption technology to protect sensitive information, giving borrowers peace of mind when applying for a loan.

* Flexible Eligibility Criteria: To apply for a loan at Kreditin, applicants only need to meet a few basic requirements. They must be Indonesian citizens aged between 18 and 55 years and have a fixed income. This flexibility allows a wide range of individuals to access the loan platform.

* Low Interest Rates: Kreditin offers competitive interest rates, making it an attractive option for borrowers seeking affordable loans. The platform aims to provide access to funds at favorable terms, ensuring that borrowers can meet their financial needs without incurring excessive costs.

FAQs:

* How much can I borrow from Kreditin?

Kreditin offers loans ranging from IDR 700,000 to IDR 7,000,000. The specific loan amount you can borrow depends on your eligibility and financial situation.

* How long does the loan approval process take?

The loan approval process at Kreditin is designed to be fast. Once you complete the application and provide the necessary documents, you can expect to receive a loan decision within a short period of time.

* What documents do I need to provide for the loan application?

To apply for a loan at Kreditin, you will need to provide identification documents such as your ID card, proof of income, and proof of residence. Additionally, you may be required to submit other supporting documents based on your individual circumstances.

* Can I make partial prepayments or repay the loan early?

Yes, Kreditin allows borrowers to make partial prepayments or repay the loan in full before the scheduled maturity date. This gives borrowers the flexibility to manage their finances and potentially save on interest charges.

Conclusion:

Kreditin - pinjaman tanpa agunan is the ideal online loan platform for individuals in need of quick and hassle-free access to funds. With a fast and easy loan process, borrowers can apply for loans ranging from IDR 700,000 to IDR 7,000,000 The platform prioritizes the security of personal information, ensuring that applicants can trust in the safety of their data. With flexible eligibility criteria and competitive interest rates, Kreditin offers an attractive solution for borrowers of diverse backgrounds. Whether you need funds for unexpected expenses or to cover financial gaps, Kreditin is here to support your financial needs. Browse, click, and download the Kreditin app today and experience the convenience and reliability of online loans.