Our app, "Income Tax Calculator India," is a must-have for every individual in India who wants to effectively plan their income tax. We understand that timely and accurate tax calculation is the responsibility of everybody, which is why we have created an easy and efficient way for you to calculate your tax liability based on your income and deductions. Our app allows you to claim deductions for various investments and expenses such as insurance, PPF, PF, ELSS, ULIP, NPS, medical insurance, education loan interest, house rent, and more. By utilizing our calculator, you can not only determine your tax liability but also make strategic investments to minimize your taxable income and save money on taxes.

Features of Income Tax Calculator India:

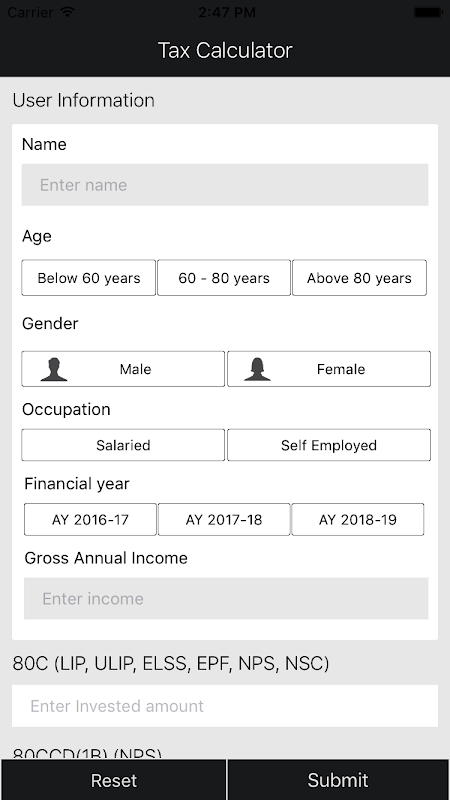

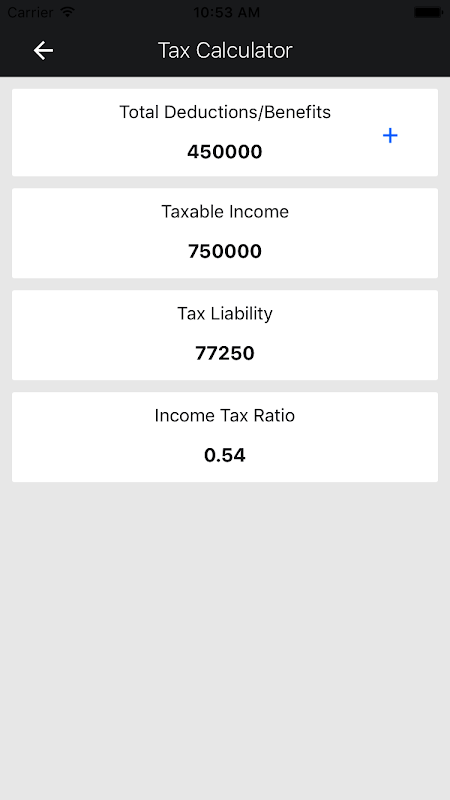

* Easy and effective tax calculation: Our Income Tax Calculator app provides a simple and user-friendly interface to calculate your tax liability accurately and effortlessly. It takes into account your income and various deductions/investments to provide you with an accurate tax amount.

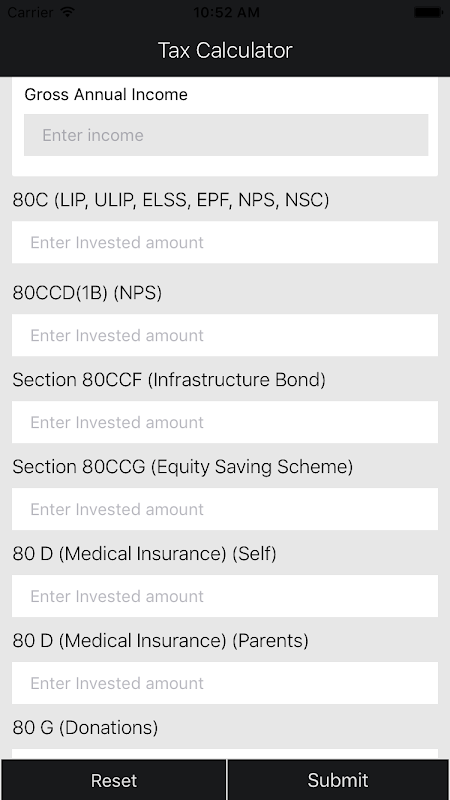

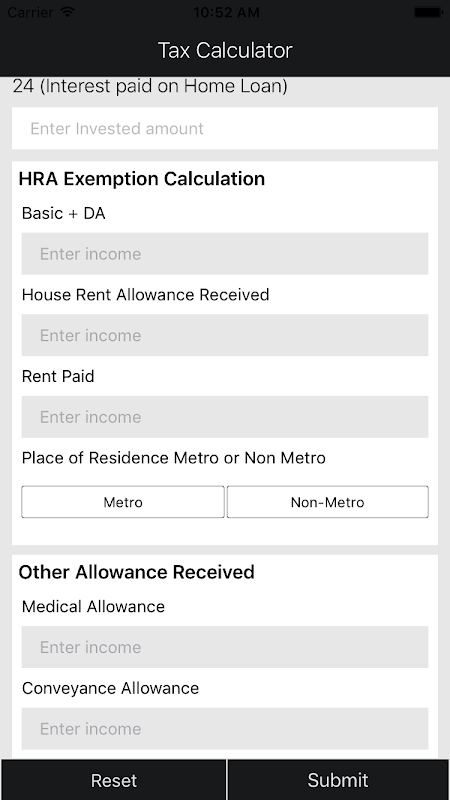

* Comprehensive deduction options: The app allows you to claim deductions for a wide range of investment options such as Insurance, PPF, PF, ELSS, ULIP, NPS, and Medical Insurance. You can also claim deductions for expenses like Education Loan Interest, House Rent, Interest & Principal Paid on Home Loan, and Donations made.

* Customized for different categories of individuals: The Income Tax Calculator app caters to the needs of various individuals, including salaried employees, self-employed individuals, and senior citizens. It provides specific deduction options and tax calculations based on your category, allowing you to maximize your tax savings.

* Tax planning made easy: Using the calculator, you can plan your investments strategically to reduce your taxable income and save on tax. The app helps you identify the best investment options to minimize tax liability, making tax planning a breeze.

Tips for Users:

* Keep track of your income and deductions: Make sure to input accurate information regarding your income and deductions/investments in the app. This will ensure that the tax calculation is precise and helps you plan better.

* Explore different deduction options: Take advantage of the various deduction options available in the app. Research and understand the eligibility criteria and benefits of different investment schemes and expenses that qualify for deductions. This will help you make informed decisions and maximize your tax savings.

* Review your tax liability regularly: Use the app periodically to assess your tax liability. This will allow you to track any changes in income or deductions and adjust your tax planning strategies accordingly. Regular reviews help ensure that you are utilizing all possible avenues to save on taxes.

Conclusion:

Income Tax Calculator India is an essential tool for every individual who wants to plan their income tax effectively. With its easy-to-use interface, comprehensive deduction options, and category-specific calculations, the app empowers users to take control of their tax planning. By accurately calculating tax liabilities and suggesting deduction options, the app helps users make informed investment decisions and maximize their tax savings. Start using the Income Tax Calculator app today to ensure timely and accurate tax planning and minimize your tax liability.