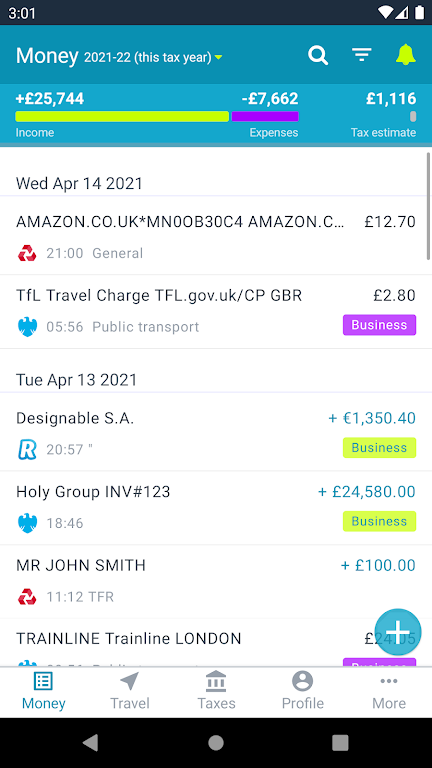

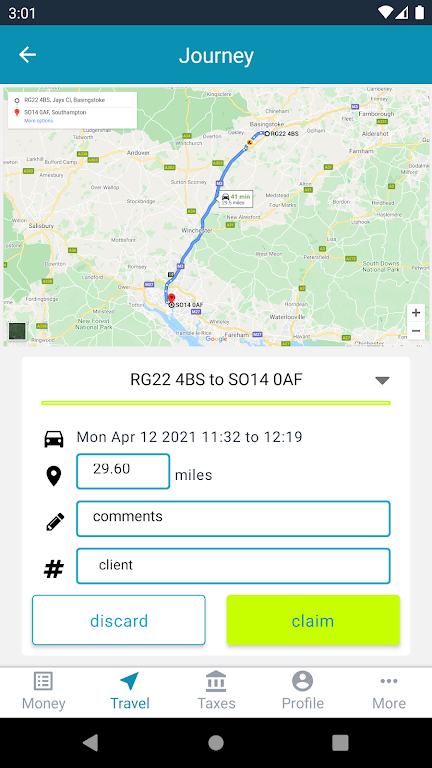

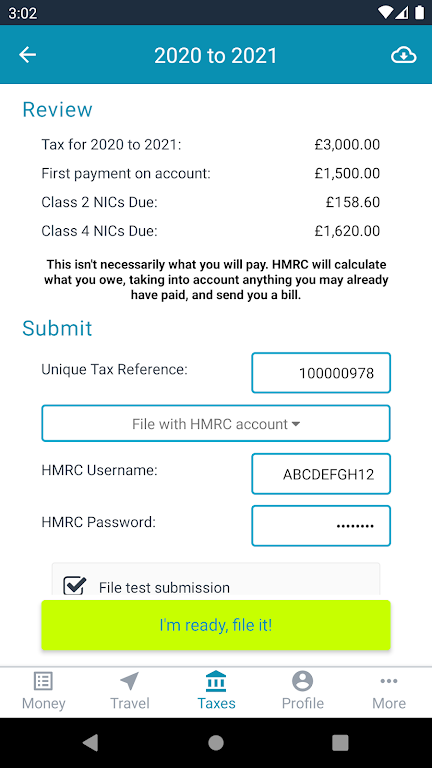

With the recognition from HMRC, untied - UK's personal tax app offers a seamless experience of preparing and filing your self-assessment tax return directly from your phone, tablet, or web browser. Its powerful features allow you to effortlessly find and tag transactions, log car and bike mileage, receive real-time tax calculations, and gain valuable insights. You can even automate your income and expense tagging with customizable rules. With untied, you can submit your tax return directly to HMRC, calculate student loan repayments, and enjoy support for various tax relief and capital gains scenarios. No matter if you're a taxpayer in England, Wales, Northern Ireland, Scotland, a non-UK resident, or a non-UK domicile, untied has got you covered. Try untied free for 30 days and experience the future of personal tax management.

Features of untied - UK's personal tax app:

⭐ HMRC Recognized: untied is a tax app that has been officially recognized by HM Revenue and Customs. This means that you can trust the accuracy and reliability of the app when it comes to preparing and filing your self-assessment tax return.

⭐ User-Friendly Interface: The app is designed to be user-friendly and easy to navigate. With just a few clicks, you can quickly find and tag your transactions, log your car and bike mileage, and set up rules to automate your income and expense tagging. This streamlined experience makes managing your taxes a breeze.

⭐ Real-Time Tax Calculation: Say goodbye to manual calculations and complex spreadsheets. untied offers real-time tax calculation, ensuring that you always have an accurate understanding of your tax liability. This feature saves you time and helps you avoid any costly mistakes when it comes to your tax return.

⭐ Comprehensive Support: Whether you're a UK resident, non-UK resident, non-UK domicile, or on the remittance basis, untied has got you covered. The app supports all tax payers in England, Wales, Northern Ireland, and Scotland, including Scottish tax bands. It also offers support for capital gains, EIS/SEIS tax relief, and calculates student loan repayments.

FAQs:

⭐ Is untied free to use?

* Currently, untied is available for free for 30 days. After the trial period, there may be a subscription fee to continue using the app. The pricing details can be found on the app's website.

⭐ Can I use untied on my desktop computer or mobile browser?

* Yes, untied - UK's personal tax app is not limited to just mobile devices. The app is also available on your desktop browser, ensuring that you can access and manage your tax information from anywhere, on any device.

⭐ Does untied support multiple bank accounts?

* Yes, untied supports unlimited bank accounts, with the majority of UK banks being supported. This feature allows you to easily track and manage your finances from different accounts in one place.

Conclusion:

With its HMRC recognition, user-friendly interface, real-time tax calculation, and comprehensive support for various tax situations, untied takes the hassle out of managing your taxes. Whether you're a UK resident or a non-UK resident, untied has all the tools and features you need to stay on top of your tax obligations. Try untied today and experience the convenience and efficiency of a modern tax app.