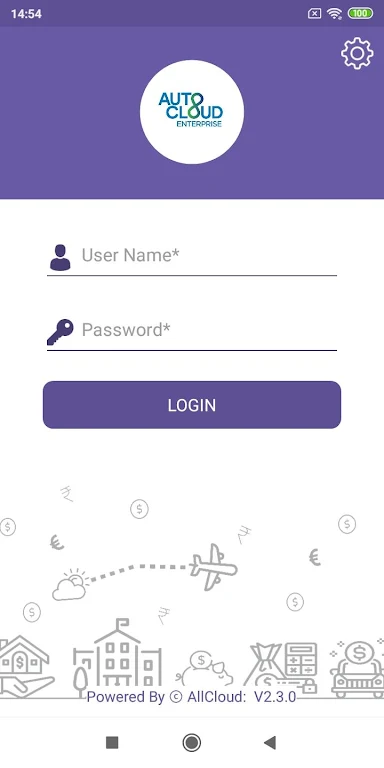

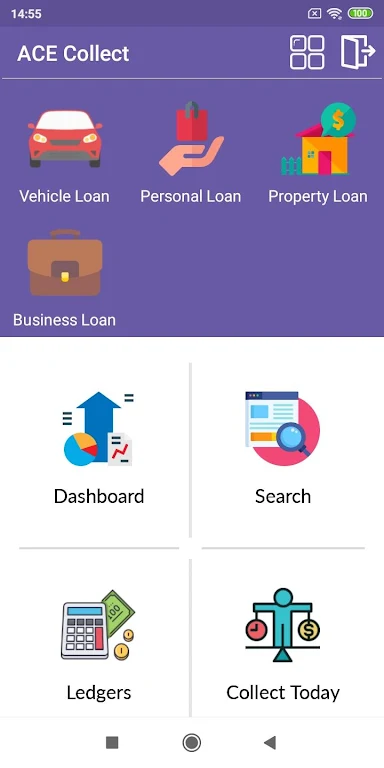

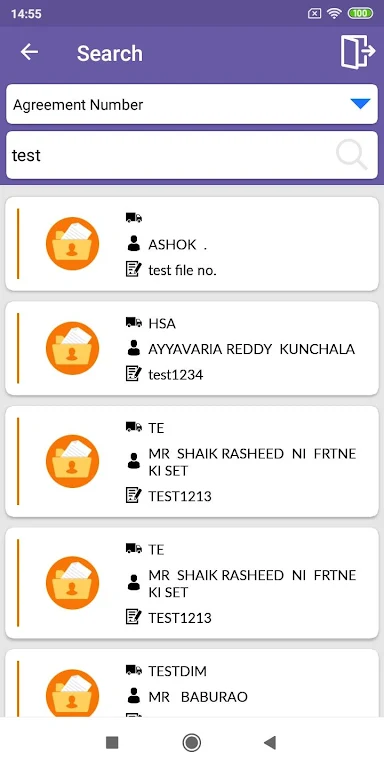

ACE Collect is a groundbreaking app designed specifically for Non-Banking Financial Companies (NBFCs), small banks, private lenders, and finance companies. This state-of-the-art, cloud-based lending platform revolutionizes the borrowing experience by simplifying the loan process and eliminating operational inefficiencies. With ACE Collect, lenders can now close loans faster than ever before through automation and configuration. This collection management system is a game-changer, allowing for seamless field collections and the effortless transfer of collection data to various agencies. From dashboard analytics and loan details to accepting repayments and printing receipts, ACE Collect has it all. Experience the future of lending with ACE Collect.

Features of ACE Collect:

- Simplified Borrowing Experience: ACE Collect Autocloud Enterprise offers a streamlined and user-friendly borrowing experience for borrowers. By automating the loan process, borrowers can easily navigate through the application, approval, and repayment process.

- Faster Loan Closures: With ACE Collect, lenders can significantly reduce the time it takes to close loans. The platform automates various tasks, such as document verification and credit checks, enabling lenders to process loans more efficiently.

- Operational Efficiency: ACE Collect helps lenders minimize operational inefficiencies by automating collection management and data transfer to collection agencies. This reduces the need for manual data entry and streamlines the collection process.

- Dashboard Analytics: The platform provides detailed analytics on collections through a comprehensive dashboard. Lenders can easily track the progress of their collections, identify trends and patterns, and make informed decisions based on real-time data.

FAQs of ACE Collect:

- Can ACE Collect be used by any size of Non-Banking Financial Company (NBFC)?

Yes, ACE Collect is designed to cater to the needs of any size of NBFC, small banks, private lenders, and finance companies.

- How does ACE Collect simplify the borrowing experience?

ACE Collect simplifies the borrowing experience by automating the loan process, eliminating the need for manual paperwork, and providing a user-friendly interface for borrowers.

- Can ACE Collect integrate with existing systems?

Yes, ACE Collect can seamlessly integrate with existing systems, allowing lenders to leverage their current infrastructure and data.

Conclusion:

With ACE Collect Autocloud Enterprise, borrowers can enjoy a simplified and efficient borrowing experience. Lenders, on the other hand, can benefit from faster loan closures, reduced operational inefficiencies, and in-depth analytics on collections. By automating various tasks and providing a user-friendly interface, ACE Collect empowers lenders to streamline their operations and make data-driven decisions. Whether you are a small NBFC or a large finance company, ACE Collect is designed to cater to your specific needs, ensuring a seamless lending experience for both lenders and borrowers.