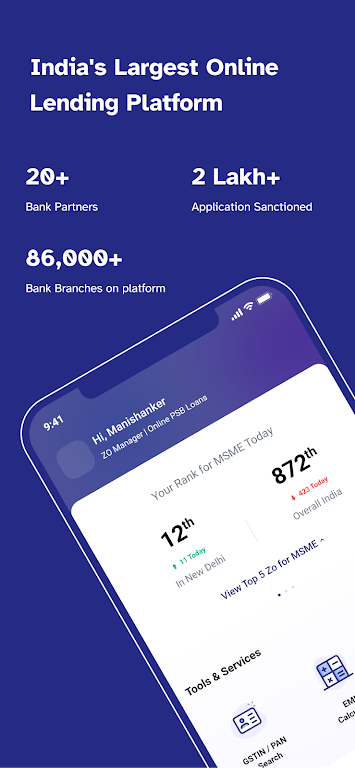

Introducing PSB59 Reports, the ultimate app designed exclusively for bankers and lenders. With this app, bankers can access real-time reporting, making their job easier than ever before. Packed with amazing features, PSB59 Reports is a must-have for any banking professional. The Training Module ensures that bankers understand their roles and responsibilities, allowing them to define parameters like industry and company risk factors. The Proposal Status Report provides valuable insights into the stage-wise strength of proposals. The Turn Around Time Report informs users about the average time spent by applications in different stages. Lastly, the Aging Report highlights the number of proposals lying dormant, giving bankers a comprehensive overview.

Features of PSB59 Reports:

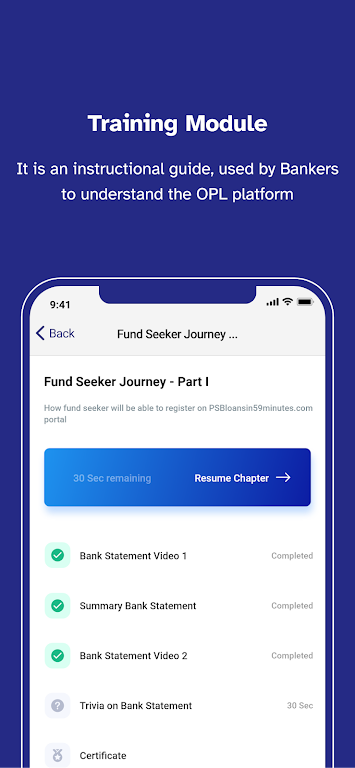

> Comprehensive Training Module: Our app includes a training module specifically designed for bankers and lenders. This module helps them understand their roles and responsibilities within the platform. Whether they are an admin maker or have another assigned role, they can easily define parameters such as industry risk factors and company risk factors. This feature ensures that bankers have a clear understanding of their tasks and can perform their jobs effectively.

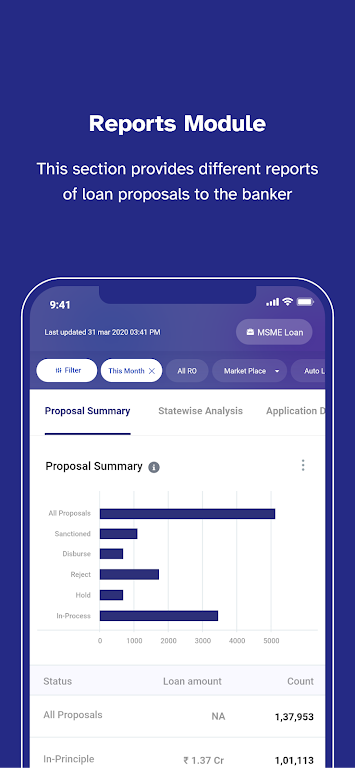

> Proposal Status Report: With our app, bankers can easily access the stage-wise strength of proposals. This report provides valuable information about the count and amount of proposals at different stages, including all proposals, in-principle, sanctioned, and disbursed. By having a clear overview of the proposal status, bankers can make informed decisions and prioritize their tasks effectively.

> Turn Around Time (TAT) Report: Our app offers a TAT report that provides bankers with crucial insights into the average duration spent by applications at different stages. Whether it's the in-principle stage or loan disbursement stage, bankers can easily track the time spent by applications. This report helps them identify bottlenecks in the process, improve efficiency, and enhance the overall customer experience.

> Aging Report: Our app's aging report allows bankers to stay updated on the number of proposals lying dormant in any specific stage. Whether it's proposals stuck in the in-principle stage or any other stage, bankers can identify and address issues promptly. By having this information at their fingertips, bankers can take proactive measures to speed up the process and ensure timely decision-making.

Tips for Users:

> Familiarize Yourself with the Training Module: Make sure to explore and understand the training module thoroughly. It provides valuable insights into your role as a banker and helps you define important parameters for risk assessment. By mastering this module, you can perform your duties efficiently and make better-informed decisions.

> Regularly Check the Proposal Status Report: Keep a close eye on the proposal status report to stay updated on the progress of different proposals. This will help you prioritize tasks, identify potential opportunities, and ensure timely actions. Regularly reviewing this report will enhance your efficiency as a banker and contribute to a smoother loan processing experience.

> Utilize the Turn Around Time (TAT) Report: Leverage the TAT report to identify any delays or bottlenecks in the loan processing stages. By analyzing the average duration spent by applications at different stages, you can streamline processes, address issues proactively, and provide a faster and more efficient experience to borrowers.

Conclusion:

PSB59 Reports for bankers and lenders offers a range of attractive features to simplify reporting and improve efficiency. The comprehensive training module ensures that bankers understand their roles and responsibilities, while the proposal status report provides valuable insights into the strength of proposals at various stages. The TAT report allows bankers to track the time spent by applications, and the aging report helps identify dormant proposals. By utilizing these features and following the playing tips, bankers can enhance their productivity and contribute to a seamless loan processing experience. Download our app now and unlock the full potential of efficient reporting for bankers and lenders.