Looking to make sense of the complex world of mortgages? Say hello to the Mortgage Calculator UK app. This incredible tool takes the confusion out of the equation, giving you the true cost of a mortgage deal in both the short and long term. With the ability to factor in monthly, annual, or one-off overpayments, you can see the impact on your monthly payments, interest paid, and even the time saved. No need to worry if you're not well-versed in mortgage jargon, as this app provides helpful explanations along the way. Plus, with the 'future' slider, you can explore how changing interest rates might affect your mortgage down the line. Whether you're in the UK or not, this app is a must-have for any mortgage hunter.

Features of Mortgage Calculator UK:

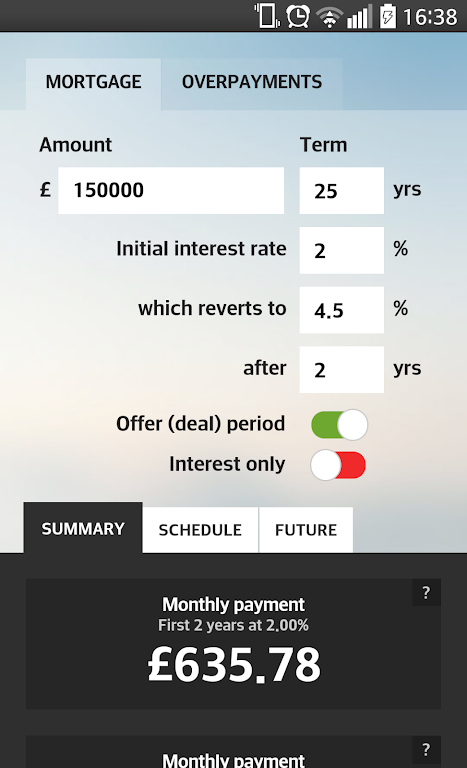

Accurate and Transparent Mortgage Costs: The Mortgage Calculator UK app takes the confusion out of mortgage deals by providing a clear breakdown of the true cost in the short and long term. No more misleading rates or hidden fees!

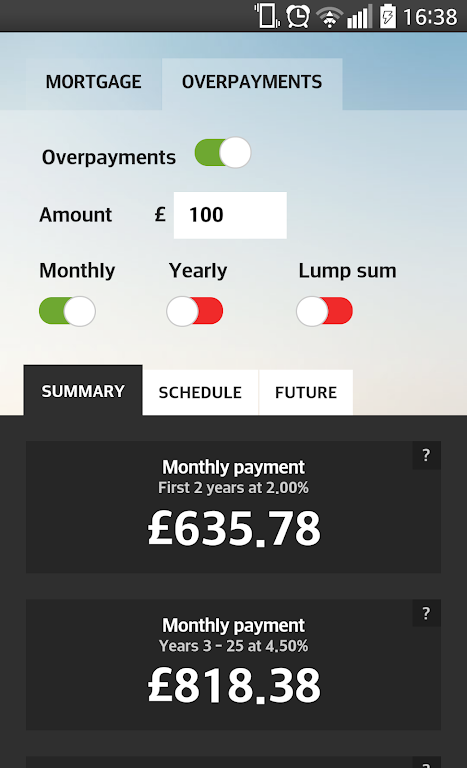

Customizable Overpayment Options: This app allows users to factor in monthly, annual, or one-off overpayments to see how they can reduce their mortgage term and save on interest. It's a great tool for financial planning and finding the most cost-effective repayment strategy.

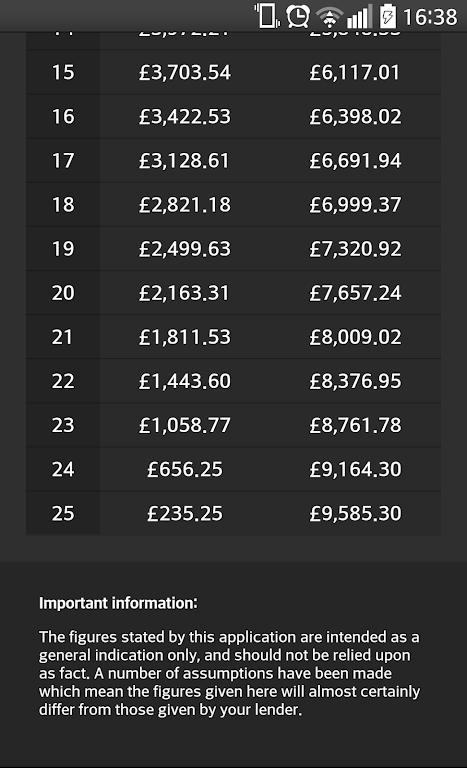

Comprehensive Payment Information: With this app, users can easily access important information such as monthly payments before and after the deal ends, interest-only payment options, time saved by overpaying, and total interest paid. It provides a complete picture of the mortgage journey.

User-Friendly Interface: The Mortgage Calculator UK app is designed to be user-friendly and accessible to all users, whether they have a deep understanding of amortization and APR or not. Helpful explanations are provided along the way to ensure clarity and understanding.

Tips for Users:

Explore Different Overpayment Scenarios: Take advantage of the app's overpayment feature to see how various payment strategies can impact your mortgage term and overall costs. Play around with different amounts and frequencies to tailor the loan to your financial goals.

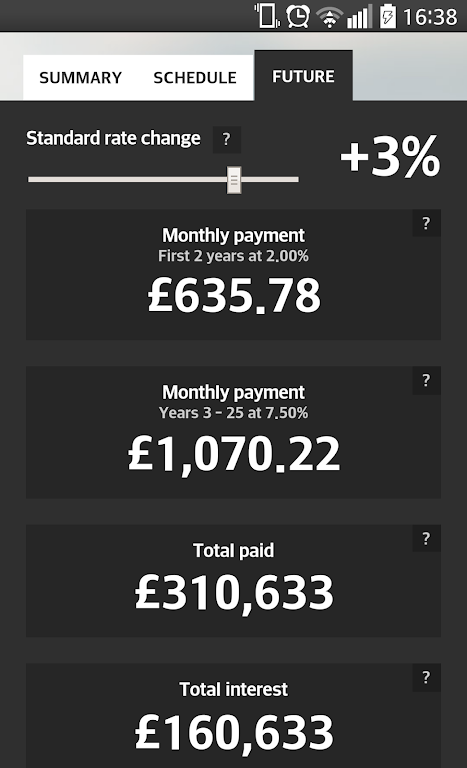

Consider Future Interest Rates: Utilize the 'future' slider feature to explore how changing interest rates may affect your mortgage after the initial offer period ends. This can help you anticipate potential changes in monthly payments and plan for possible rate increases.

Utilize the Education Resources: Take advantage of the helpful information provided throughout the app. If you're unfamiliar with mortgage jargon or terms, make use of the explanations available to fully understand the impact of each number provided.

Conclusion:

The Mortgage Calculator UK app is an essential tool for anyone seeking a mortgage, whether they are located in the UK or not. With its accurate calculation of mortgage costs, customizable overpayment options, comprehensive payment information, and user-friendly interface, it provides the necessary tools to make informed decisions. By exploring different overpayment scenarios and considering future interest rates, users can optimize their mortgage repayment strategy. Whether you're a first-time buyer or refinancing, this app empowers users to navigate the complexities of mortgages and find the best mortgage deal for their long-term financial goals.