myABL is a cutting-edge mobile banking app that offers a secure and convenient way to handle all your banking needs on the go. With biometric login options like Touch ID and Face ID for iPhone users, you can easily access your account with just a touch or a glance. The app also features in-app biometric verification for added security. From managing your personal finances to updating your personal information and handling debit card management, myABL has got you covered. Plus, you can easily purchase bus, movie, and event tickets, make voice-assisted banking transfers, pay bills, top up your mobile, and much more. With it, you can stay in control of your finances anytime, anywhere.

Features of myABL:

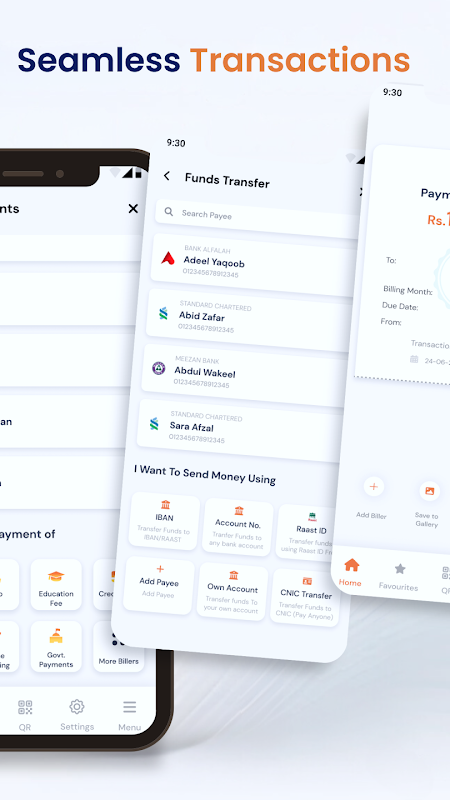

Convenient Banking on the Go: With it, you can easily take control of your finances wherever you are. Whether you need to check your account balance, pay bills, or transfer funds, this mobile banking app has got you covered.

Enhanced Security: The app offers biometric login with Touch ID, ensuring that only you can access your accounts. It also has in-app biometric verification, adding an extra layer of security to your transactions.

Comprehensive Financial Management: myABL provides personal finance management tools that allow you to keep track of your expenses, set budgets, and analyze your spending habits. It helps you stay on top of your financial goals and make informed decisions.

Seamless Card Management: With it, you can easily manage your debit card. From activation and PIN generation to temporary blocking and unblocking, you have full control over your card. You can also allow international and eCommerce use for added convenience.

Tips for Users:

Explore the Voice Assisted Banking Feature: Take advantage of the Siri integration for iPhone users. You can use voice commands to inquire about your account balance, transfer funds, or check your ABL Credit Card balance. It's a quick and hands-free way to access your banking information.

Set Up Favorite Transfers and Payments: Save time by marking your frequent transfers and bill payments as favorites. This way, you can easily access and initiate them with just a few taps, without having to input all the details every time.

Opt for E-Statements: Subscribe to E-Statements on different frequencies to receive your account statements electronically. It's a secure and eco-friendly option that eliminates the need for paper statements.

Utilize Mini & Full Account Statements: Take advantage of the mini and full account statement features to keep track of your transactions. Whether you need a quick overview or a detailed breakdown, these statements provide you with the information you need.

Conclusion:

With myABL, managing your finances has never been easier. The app offers convenience, enhanced security, and comprehensive financial management tools. From biometric login and card management to voice-assisted banking, it caters to your banking needs on the go. By following the playing tips, you can further optimize your experience and make the most out of the app's features. Start banking smarter today with myABL and stay in control of your finances wherever you are. Download now and experience a new level of convenience and security.