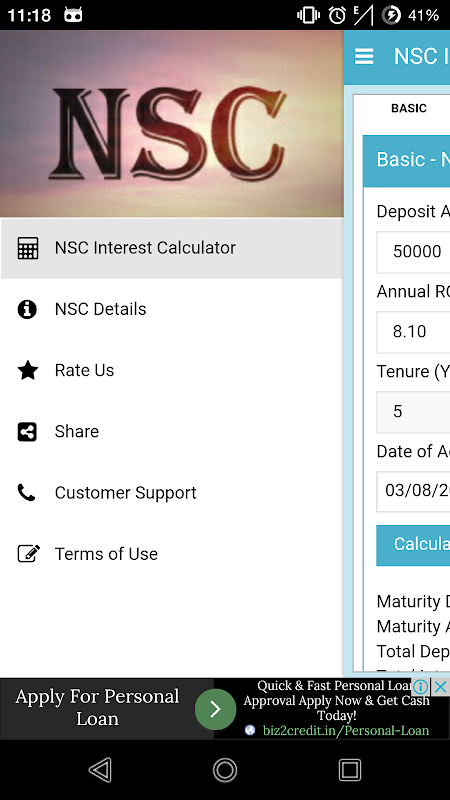

The NSC Interest Calculator is a must-have app for anyone looking to invest in National Savings Certificates in India. This versatile calculator allows you to easily calculate the maturity amount of your NSC investment made through the Post Office. Whether you are a small saver or looking for tax-saving investments, the NSC is a great option. With this app, you can calculate the maturity amount for various types of NSCs, including individual, joint, and payable certificates. Don't miss out on the benefits of NSC investment – download the NSC Interest Calculator app today!

Features of NSC Interest Calculator:

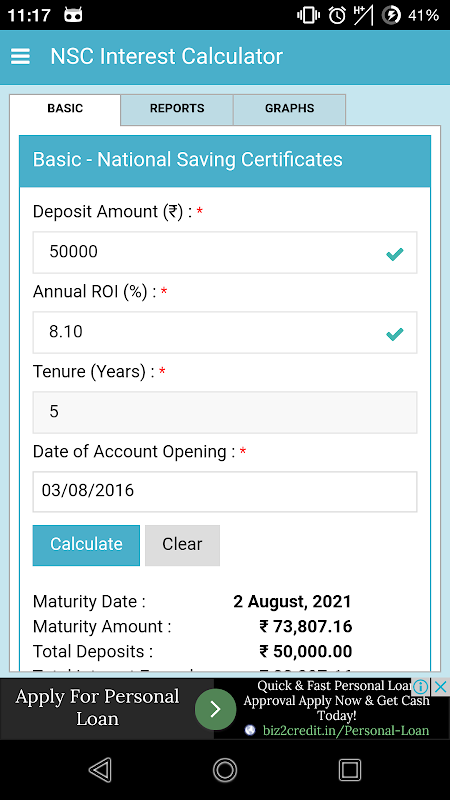

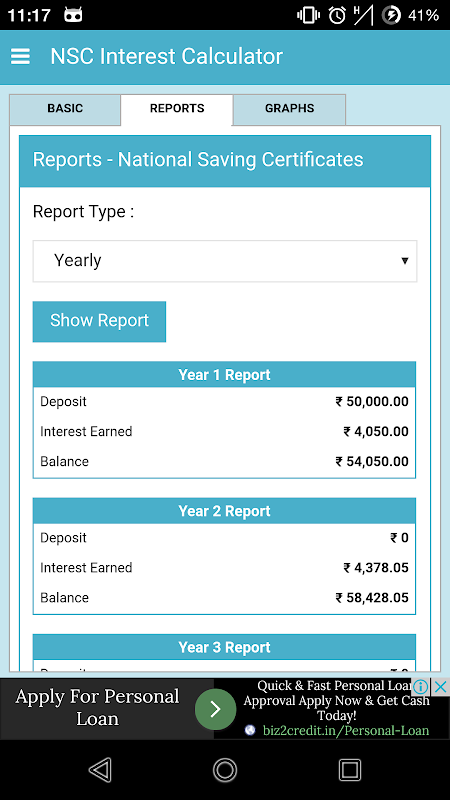

Adaptable Calculator: The NSC Calculator is a versatile tool that can be used to calculate the maturity amount of National Savings Certificates (NSC) invested in Post Office for a specified period.

Income Tax Saving: NSC is primarily used for small savings and income tax saving investments in India. It allows individuals to save money and also claim tax deductions.

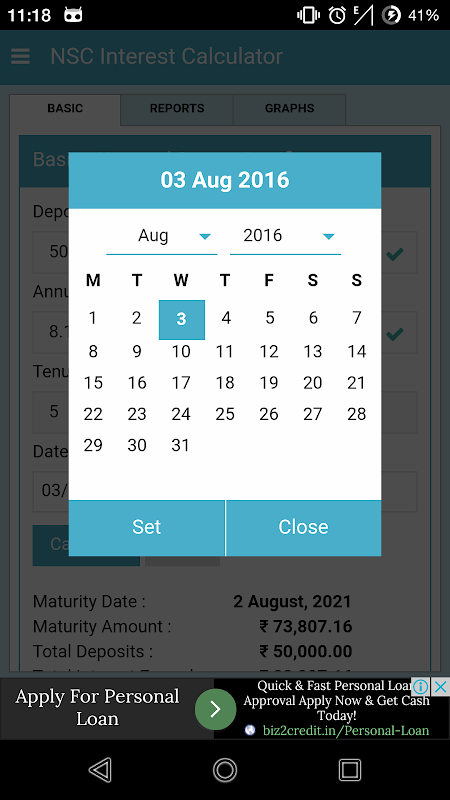

Easy to Use: This android app is designed to be easy to understand and use. Users can quickly navigate through the different features and input the necessary data for accurate calculations.

Graphical Visualization: The NSC calculator allows users to visualize the calculations graphically, making it easier to understand and interpret the results.

Offline Functionality: No internet connection is required to use the NSC Calculator. Users can access and use the app anywhere, anytime, without worrying about connectivity.

Tips for Users:

Calculate Maturity Amount: Use the NSC Calculator to input the investment amount, rate of interest, and tenure to calculate the maturity amount. This will help users plan their savings and make informed investment decisions.

Tax Planning: Utilize the NSC Calculator to calculate the tax savings and deductions under Section 80C of the Income Tax Act. This will enable individuals to effectively plan their tax liability and maximize their savings.

Compare Investments: The app allows users to compare the maturity amounts of different NSC investments based on varying tenures and interest rates. This can help individuals choose the most suitable investment option.

Conclusion:

With its adaptable calculator, easy-to-use interface, graphical visualization, and offline functionality, the app provides users with a convenient way to calculate the maturity amount of their NSC investments. By utilizing the app's features and following the playing tips, users can effectively plan their savings, optimize their tax liabilities, and make informed investment decisions. Download the NSC Interest Calculator app now to simplify your financial calculations and achieve your savings goals.