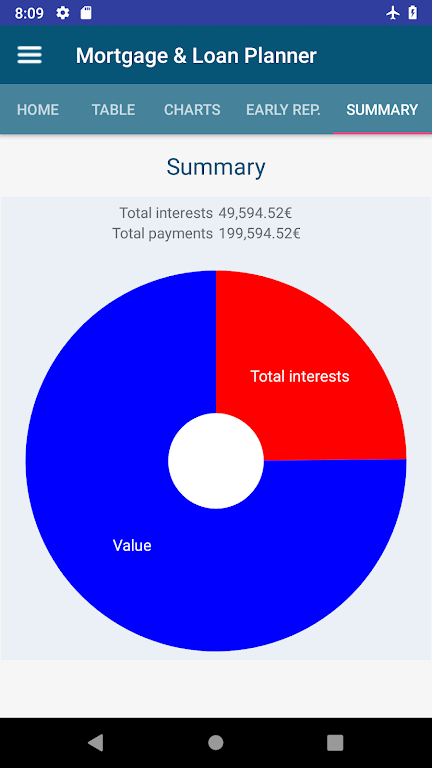

The Mortgage & Loan Planner app is a powerful tool designed to help you make informed decisions when it comes to signing a contract with your bank. This easy-to-use and intuitive app offers a range of features, from basic payment calculations to advanced options like early repayment and interactive graphics. Its main highlight is the use of the French amortization formula, which ensures accurate and reliable results. With this app, you can easily evaluate the payment of a mortgage based on variables such as price, interest rate, and time. Take control of your financial future with the Mortgage & Loan Planner app.

Features of Mortgage & Loan Planner:

* French Amortization Formula:

Our Mortgage and Loan Simulator uses the French amortization formula, which is widely recognized as the most accurate and reliable method for calculating mortgage payments. This formula takes into account a fixed annual interest rate and monthly payment periodicity, ensuring accurate calculations for your mortgage.

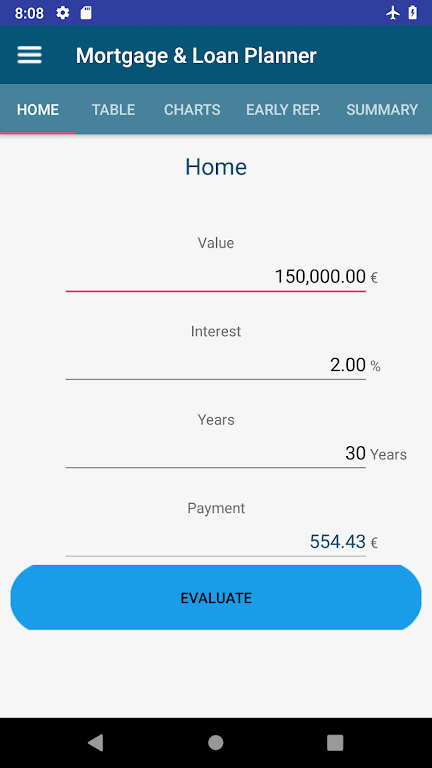

* Payment Evaluation:

With our app, you can easily evaluate the payment of a mortgage by inputting the price or value of the property, the interest rate, and the loan term. Our advanced calculator will provide you with an accurate estimate of your monthly payment, helping you make informed decisions about your loan.

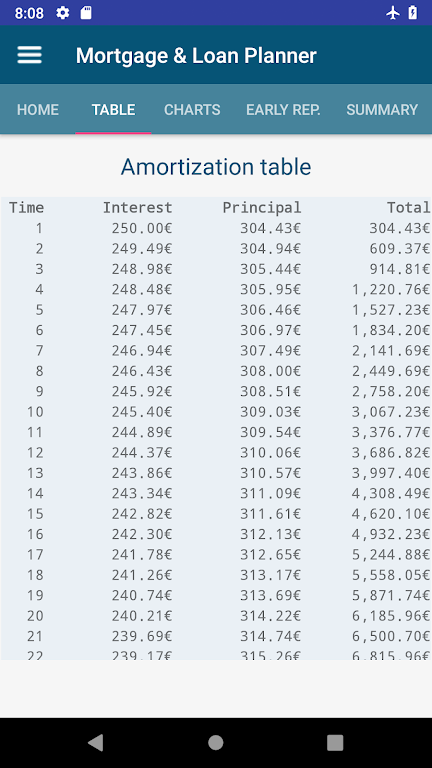

* Amortization Table:

Our app provides a detailed amortization table that shows you exactly how your mortgage payments are allocated between reducing the principal amount and paying interest over the duration of the loan. This feature allows you to monitor your progress in building equity and understand the impact of interest on your overall loan.

Tips for Users:

* Explore Different Scenarios:

Take advantage of the interactive nature of our app's graphics and play around with different scenarios. Adjust the price or value of the property, interest rates, and loan terms to see how they impact your monthly payment and overall financial situation. This will help you make a well-informed decision about your mortgage.

* Consider Early Repayment:

Use the early repayment feature of our simulator to determine how making additional payments towards your mortgage principal can save you money in the long run. By inputting different repayment amounts, you can see the impact on your loan term and interest paid, allowing you to better manage your finances.

* Review the Amortization Table:

Regularly review the detailed amortization table provided by our app to track your progress in paying off your mortgage. This will help you understand how much of your monthly payment goes towards reducing your principal and how much is being paid as interest. You can use this information to make informed decisions about refinancing or making extra payments to reduce your interest costs.

Conclusion:

From using the French amortization formula for accurate calculations to providing an amortization table for monitoring payment allocation, our app offers a comprehensive understanding of your mortgage. By exploring different scenarios and considering early repayment, users can optimize their financial strategy and save money in the long run. Download Mortgage & Loan Planner now and take control of your mortgage planning today!