Mini - Canal Circle

| Package ID: | |

|---|---|

| Latest Version: | v2021.5.1 |

| Latest update: | Sep 25, 2024 13:29:04 |

| Developer: | Canal Circle Pte. Ltd. |

| Requirements: | Android |

| Category: | Finance |

| Size: | 23.20 MB |

| Tags: | Office Navigation Date |

Mini - Canal Circle is the ultimate solution for microfinance units to streamline their customer management process. With this innovative application, credit officers can effortlessly handle a large number of customers, catering to all microcredit business requirements. From adding new customers to creating loan profiles and inputting borrower data, every task can be easily accomplished. What sets Canal Circle Mini apart is its advanced functionality of providing loan information and suggestions, as well as analyzing borrower data to ensure informed decision-making. Additionally, loan records can be conveniently managed, and loan documents can be effortlessly printed. Experience the power of efficient microfinance management with Canal Circle Mini.

Features of Mini - Canal Circle:

⭐ Simplified Customer Management: Mini streamlines the process of managing customer information for microfinance units. Instead of sifting through numerous files and documents, credit officers can easily add customers and create new loan profiles within the app. This saves time and ensures that all customer data is easily accessible and organized in one place.

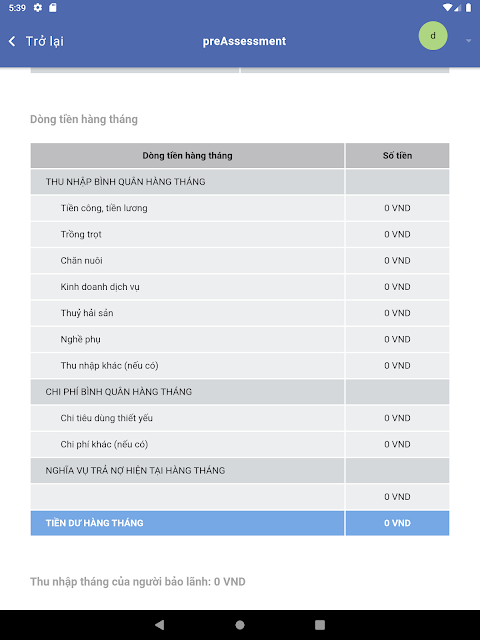

⭐ Efficient Loan Processing: With Mini, credit officers can input borrowers' data quickly and accurately. The app provides suggestions for suitable loans based on the borrowers' information, enabling credit officers to make informed decisions. This not only speeds up the loan approval process but also ensures that borrowers receive loans that meet their needs.

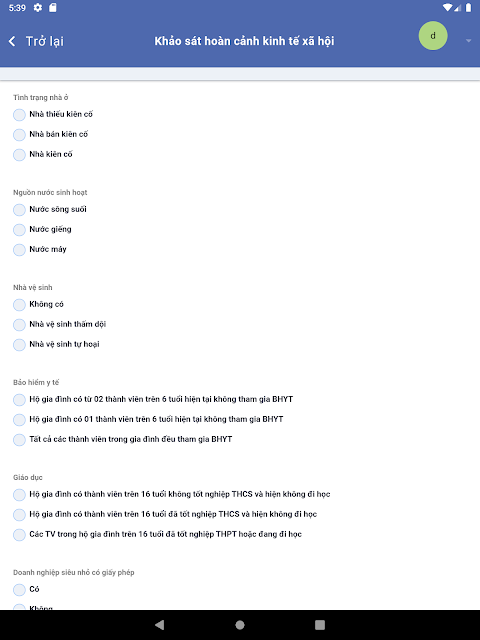

⭐ Advanced Data Analysis: Mini goes beyond basic customer management by helping credit officers analyze borrowers' data. The app uses advanced algorithms to extract valuable insights, allowing credit officers to make data-driven decisions. This feature is especially useful in assessing borrowers' creditworthiness and identifying potential risks.

⭐ Convenient Loan Record Management: Keeping track of loan records is made easy with Mini. Credit officers can manage loan documents conveniently within the app, eliminating the need for physical paperwork. The app allows for easy search, retrieval, and update of loan records, ensuring accurate and up-to-date information at all times.

Tips for Users:

⭐ Familiarize yourself with the app interface: Take some time to explore the different features and menus of Mini. Understanding the app's layout and navigation will help you navigate through customer management and loan processing more efficiently.

⭐ Input accurate borrower data: Ensure that the information you input for borrowers is accurate and up-to-date. This will help Mini provide accurate loan suggestions and improve the overall loan approval process.

⭐ Utilize the data analysis feature: Take advantage of Mini's advanced data analysis capabilities. Make use of the insights provided by the app to assess borrowers' creditworthiness and identify potential risks associated with loans.

⭐ Regularly update loan records: Keep loan records updated within Mini. Regularly review and update customer information, loan details, and repayment status to ensure accurate data management and efficient loan record keeping.

Conclusion:

With its simplified customer management, efficient loan processing, advanced data analysis, and convenient loan record management features, Mini provides a comprehensive solution for credit officers. By utilizing the playing tips mentioned above, users can maximize the app's functionalities and optimize their microcredit business needs. Download Mini - Canal Circle now to revolutionize your microfinance unit's management and improve customer satisfaction.