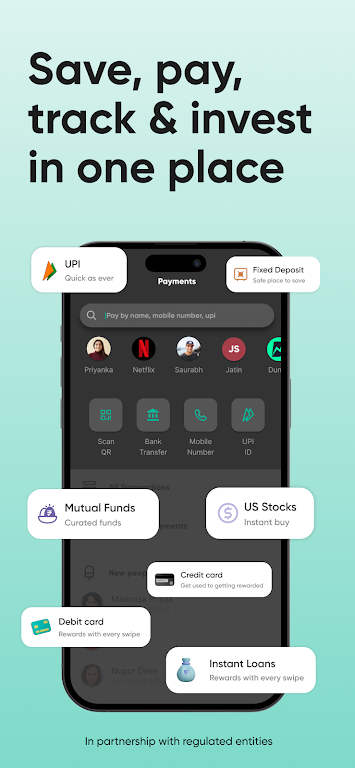

Introducing Fi Money: Save, Pay & Invest, the ultimate money management app that covers all your financial needs. With Fi, you can open a zero-balance savings account in just a few minutes, track your expenses, maximize your savings, apply for personal loans and credit cards, automate UPI payments, invest in Mutual Funds, and build your wealth. Plus, you'll get a sleek VISA Debit Card and Credit Card with zero FOREX charges. With Fi, your money is insured up to ₹5 lakh, there are no minimum balances or hidden fees, and you can withdraw from any ATM. Experience the joy of growing your money with Fi Money!

Features of Fi Money: Save, Pay & Invest:

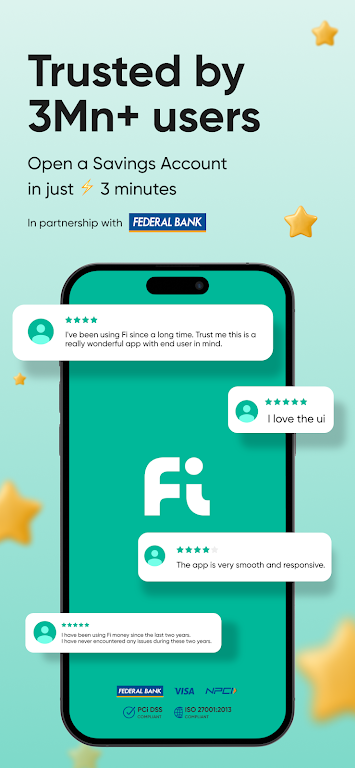

❤ Open a Zero-Balance Savings Account: With Fi Money, you can easily open a zero-balance savings account online in just under 3 minutes. This allows you to start saving without any hassle or minimum balance requirement.

❤ Track Your Expenses: Fi Money helps you make sense of your personal finance by providing you with a clear overview of your expenses. You can easily keep track of where your money is going and make informed decisions about your spending habits.

❤ Automated Savings and Investments: Fi Money offers several features to help you save and invest effortlessly. The FIT Rules feature allows you to set fun rules that automatically save money for you. You can also automate investments and transfer money into Mutual Funds on a daily, weekly, or monthly basis.

❤ Convenient Financial Services: Fi Money is a comprehensive money management platform that provides various financial services. You can apply for an instant personal loan, apply for a credit card online, automate UPI payments, and build your wealth through investments in Mutual Funds.

❤ Sleek VISA Debit Card and Credit Card: By using Fi Money, you can get a sleek VISA Debit Card and Credit Card with zero FOREX charges. This allows you to make international transactions without worrying about additional fees.

Tips for Users:

❤ Use Ask Fi: Take advantage of Fi Money's intuitive personal finance assistant, Ask Fi. It provides simple answers and guidance regarding your financial queries, making it easier for you to manage your money effectively.

❤ Set Up AutoSave and AutoPay: Create AutoSave and AutoPay rules to save and pay your bills automatically. This ensures that you consistently save money and never miss any important payments.

❤ Take Advantage of Smart Deposit: Fi Money's Smart Deposit feature allows you to save money in a flexible way that suits your goals. You can easily deposit money and track your progress towards your savings targets.

Conclusion:

From opening a savings account online to tracking expenses, automating savings and investments, and accessing various financial services, Fi Money has got you covered. With the additional benefits of a sleek VISA Debit Card, zero FOREX charges, and 24/7 customer support, it truly stands out as the go-to app for all your financial needs. Download Fi Money: Save, Pay & Invest now and start taking control of your finances.