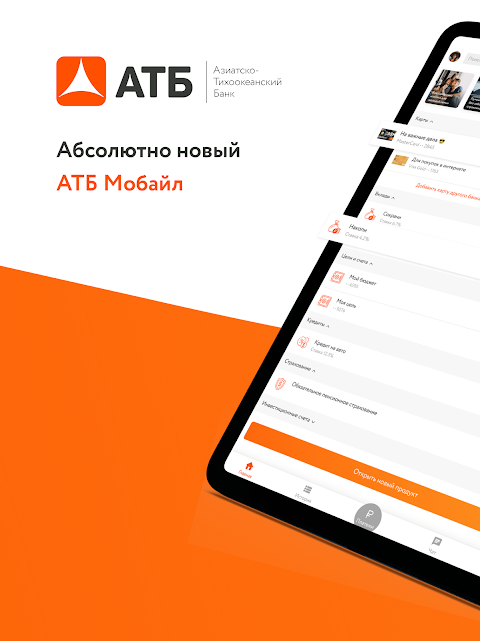

Introducing АТБ Мобайл, the innovative and user-friendly mobile application that gives you round-the-clock access to a wide range of financial and non-financial services without any need for queues, even on weekends and holidays. This app is designed with customer preferences and requests in mind, making it easy to navigate and discover new products. With ATB Mobile NEW, you can register on your own, without making any unnecessary calls to the bank. Enjoy complete information on loans, deposits, and mortgages, open accounts online without visiting a branch, and easily apply for credit cards, loans, or mortgages. You can also conveniently block your bank card, track your expenses, access current rates and currency exchange information, and make various payments and transfers effortlessly. ATB Mobile NEW is dedicated to providing you with a seamless and secure banking experience.

Features of АТБ Мобайл:

⭐ Full information on issued products: Users can access detailed information about their loans, deposits, and mortgages through the app. This includes the specific details of the products and the amount of the monthly payment.

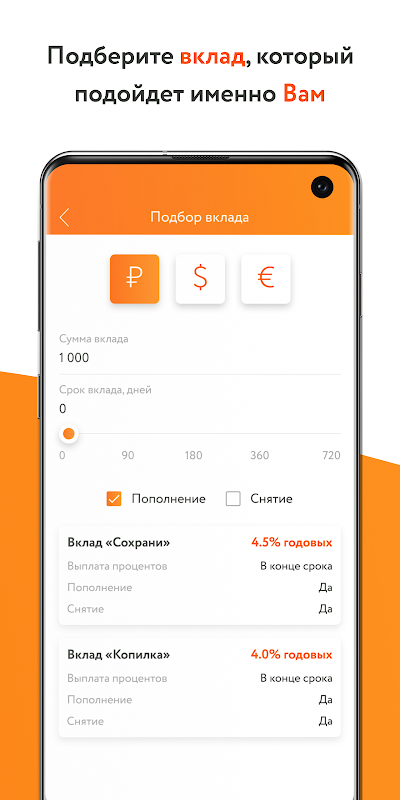

⭐ Online opening of products: Users can open new deposits and savings accounts online without the need to visit a bank office. This eliminates unnecessary movements and allows for a more convenient and efficient banking experience.

⭐ Remote registration of applications: Users can now easily send applications for credit cards, consumer loans, or mortgages directly through the app. This eliminates the need for time-consuming phone calls or visits to the bank.

⭐ Remote blocking of a bank card: In case of loss or theft, users can remotely block their bank cards through the app. This provides an added layer of security and gives users peace of mind knowing that their financial transactions are protected.

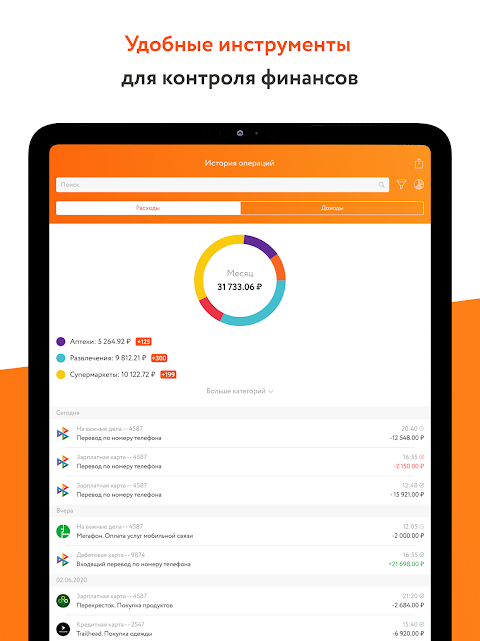

⭐ Analytics on expense transactions and activity: The app provides users with a comprehensive overview of their expense transactions and activity by product. This allows users to easily track their financial history and make informed decisions based on their spending patterns.

⭐ Actual rates and currency exchange: Users can stay up to date with the latest exchange rates and easily perform currency conversions through the app. This feature is particularly useful for users who frequently travel or engage in international transactions.

Tips for Users:

⭐ Explore the product details: Take advantage of the full information provided on your issued products. This will help you better understand the terms and conditions, as well as manage your payments effectively.

⭐ Utilize online opening of products: Instead of visiting a bank office, use the app to open new deposits and savings accounts. This saves time and allows you to open accounts from the comfort of your own home.

⭐ Take advantage of remote registration: Avoid unnecessary phone calls or visits to the bank by using the app to send applications for credit cards, loans, or mortgages. The remote registration feature streamlines the application process and makes it more convenient for you.

⭐ Monitor your expenses and activity: Regularly check the analytics section to track your expense transactions and activity by product. This will help you stay on top of your finances and make smarter financial decisions.

⭐ Stay updated on rates and exchange rates: Keep an eye on the actual rates and currency exchange feature to stay informed about the latest rates. This will help you make timely decisions regarding currency conversions and international transactions.

Conclusion:

From full information on issued products to remote registration of applications, the app is designed to meet the needs and preferences of users. With the ability to open products online, block bank cards remotely, and access analytics on expenses and activities, users can easily manage their finances from anywhere at any time. The app also provides current rates and currency exchange features, ensuring users stay updated on the latest financial trends. With АТБ Мобайл, users can enjoy a seamless and secure banking experience.