Money View: Money Manager is an innovative personal finance management app that makes tracking and managing your expenses effortless. With its user-friendly interface, the app automatically tracks your expenses by reading SMS notifications from your bank and billers. It also sends you payment reminders to ensure that you never miss a bill again. In addition, Money Manager consolidates all your credit and debit balances in one convenient place, allowing you to get a clear view of your financial standing. What sets Money Manager apart is its unique feature of offering instant personal loans of up to Rs. 1,000,000 within just a few hours. So, whether you need funds for a medical emergency or a vacation, Money Manager has got you covered. With flexible repayment options and competitive interest rates, you can easily take advantage of this loan facility. Say goodbye to manual budgeting and financial stress, and embrace the future of personal finance management with Money Manager app.

Features of Money View: Money Manager:

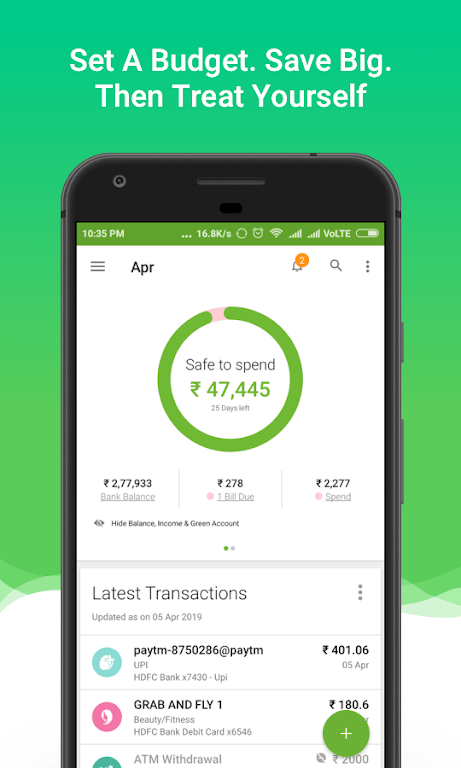

❤ Automatic Expense Tracking: One of the key features of the Money View Money Manager app is its ability to automatically track your expenses. Through SMS integration, the app reads your transactional messages from billers and categorizes them into various expense categories. This saves you the hassle of manually entering your expenses and provides a comprehensive view of your finances effortlessly.

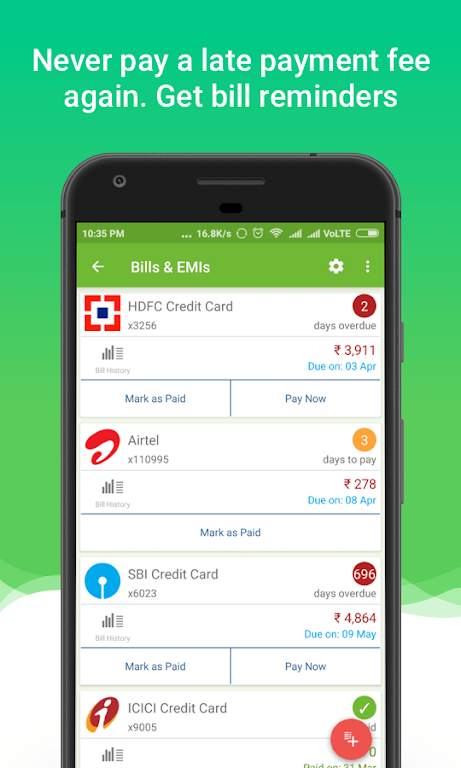

❤ Payment Reminders: With the app's payment reminder feature, you can ensure that you never miss a bill payment again. The app tracks SMS notifications from banks and billers and sends you reminders for upcoming payments. This helps you stay organized and avoid late payment fees or penalties.

❤ Centralized Balance Check: Instead of logging into multiple bank accounts and credit card portals, the Money View Money Manager app allows you to check all your balances in one place. By tracking SMS notifications from banks, the app provides you with an overview of your credit and debit balances, making it easier to monitor your financial health.

❤ Effortless Reimbursement Tracking: If you frequently need to track and reimburse expenses for work or personal purposes, the app makes it effortless for you. By scanning your SMS messages related to reimbursements, the app categorizes and tracks them separately. This simplifies the reimbursement process and ensures you never miss out on what you're owed.

FAQs:

❤ Is my financial data secure with Money View Money Manager?

Yes, Money View takes the security and privacy of your financial data seriously. We use advanced encryption protocols and follow industry best practices to protect your information. You can trust that your data is safe with us.

❤ Can I customize expense categories?

Yes, you have the option to customize expense categories in the app according to your preferences. This allows you to manage your expenses in a way that makes sense to you and fits your unique financial situation.

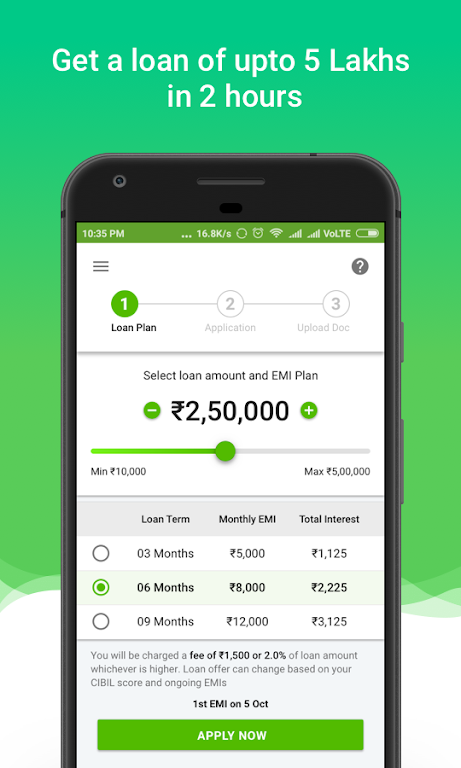

❤ How long does it take to get an instant personal loan?

The app offers instant personal loans of up to Rs.1,000,000. Once your loan application is approved, you can expect to receive the funds within a few hours. The exact time may vary depending on the bank and other factors.

Conclusion:

The app's ability to read and categorize SMS notifications from billers saves you time and effort, while its loan feature offers quick access to funds when needed. By utilizing the app's features, you can stay on top of your expenses, avoid late payments, and make informed financial decisions. Download Money View: Money Manager now and take control of your finances.