Money Dashboard Budget Planner is a user-friendly app that allows you to effortlessly track all of your spending and income in one secure place, regardless of which bank you use. With this app, you can make daily savings, cut down on household bills, and make more informed financial decisions by understanding exactly where your money goes each month. Whether you're paying off debts or looking to build up savings, Money Dashboard's award-winning budget planner takes away the stress of managing your money. It categorizes your spending automatically, helping you avoid falling into debt, and provides clear charts and helpful visuals for a more enjoyable financial experience. This app supports all major UK banks and employs top-notch security practices to keep your information safe. With Money Dashboard, you can take control of your finances and live a happier financial life.

Features of Money Dashboard Budget Planner:

⭐ Comprehensive Account Tracking:

Money Dashboard allows you to track all your spending and income across your current, credit card, and savings accounts, regardless of which bank you use. This feature provides a complete overview of your financial situation in one convenient app.

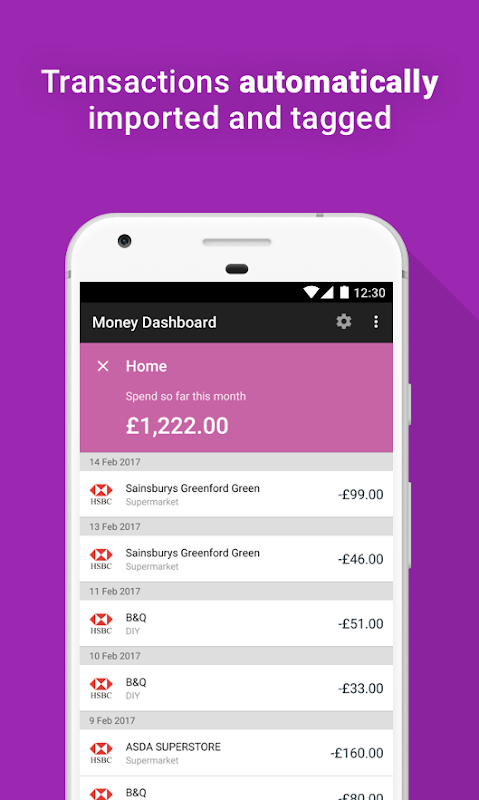

⭐ Automatic Categorization:

The app's award-winning budget planner simplifies money management by automatically categorizing your expenses, from groceries to leisure activities and household bills. This helps you understand where your money is going and avoid falling into debt.

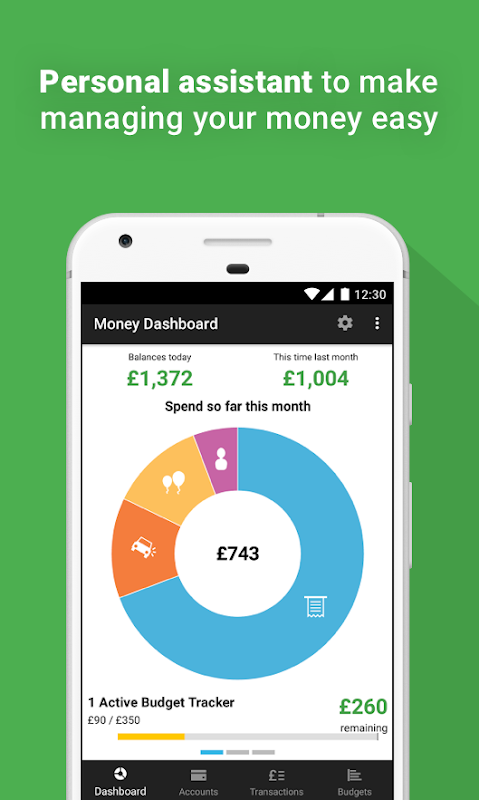

⭐ Clear and Helpful Charts:

Money Dashboard presents all your financial information in clear and helpful charts. These charts give you a visual representation of your spending patterns, allowing you to make more informed financial decisions and take control of your money.

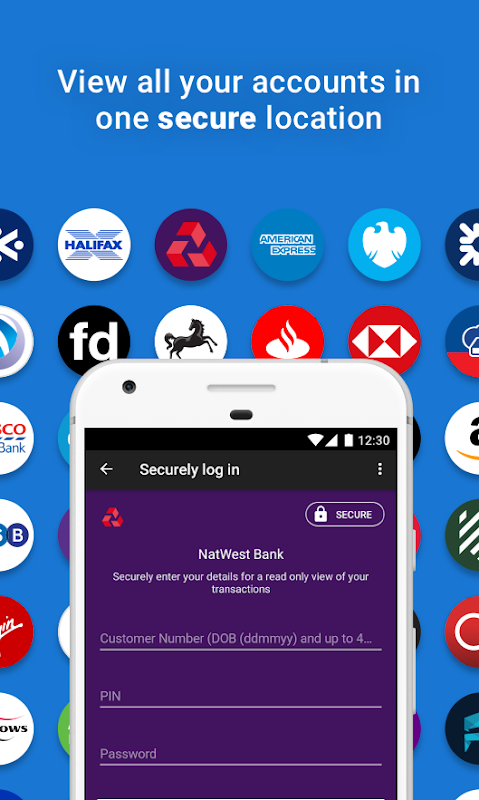

⭐ Support for Major UK Banks:

Money Dashboard supports all major UK current accounts, savings accounts, and credit cards. This means you can connect directly to your online banking with trusted providers like Barclays, HSBC, Lloyds, Natwest, Nationwide, and RBS.

Tips for Users:

⭐ Regularly Review Your Transactions:

To make the most of Money Dashboard, it's important to regularly review your transactions. This will help you identify areas where you can cut unnecessary expenses and make better financial choices.

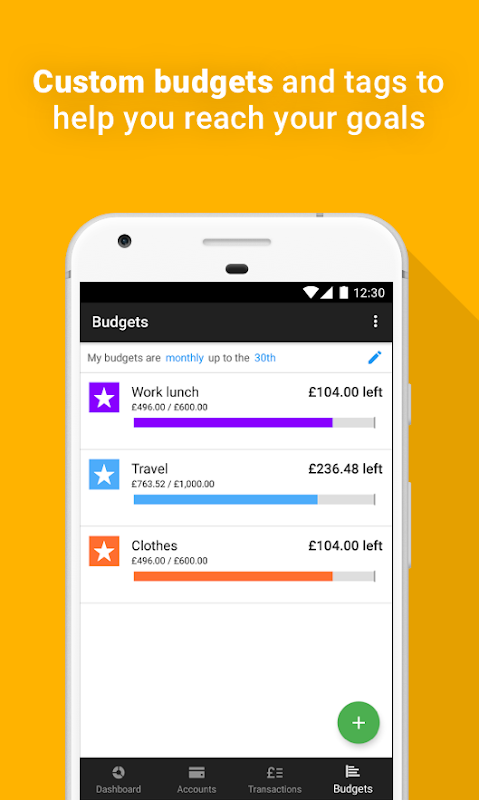

⭐ Set Realistic Budgets:

Take advantage of the app's budget planner feature to create informed budgets based on your previous month's spending. This will help ensure that you allocate your salary towards the things you truly want, enabling you to reach your financial goals more effectively.

⭐ Utilize the Additional Functionality:

Money Dashboard offers additional functionality on its website, including a cashflow planner. Take advantage of these tools to avoid using your overdraft unnecessarily and plan your way out of debt. Explore all the features the app has to offer to maximize your financial management experience.

Conclusion:

With its comprehensive account tracking, automatic categorization, clear charts, and support for major UK banks, the app offers a user-friendly and secure way to manage your money. By regularly reviewing transactions, setting realistic budgets, and utilizing the additional functionality, you can make informed financial decisions, save money, and ultimately live a happier financial life. Don't just take our word for it, leading publications like BBC, The Times, The Independent, and Evening Standard have also praised Money Dashboard for its effectiveness in budgeting. Download Money Dashboard Budget Planner now and start transforming your relationship with money.