Introducing the PaySense Partner App, a game-changer in the world of personal loans and financing options. With already over 10,00,000 satisfied users, this app is here to help you and your customers in times of need. Whether it's a medical emergency, education expenses, marriage costs, or even upgrading to that new gadget, PaySense has got you covered. The best part? No more worrying about credit scores or credit cards. PaySense serves everyone, from salaried individuals to self-employed entrepreneurs. With loan amounts ranging from ₹5000 to ₹500,000 and flexible repayment plans from 3 to 60 months, this app is your financial lifeline.

Features of PaySense Partner:

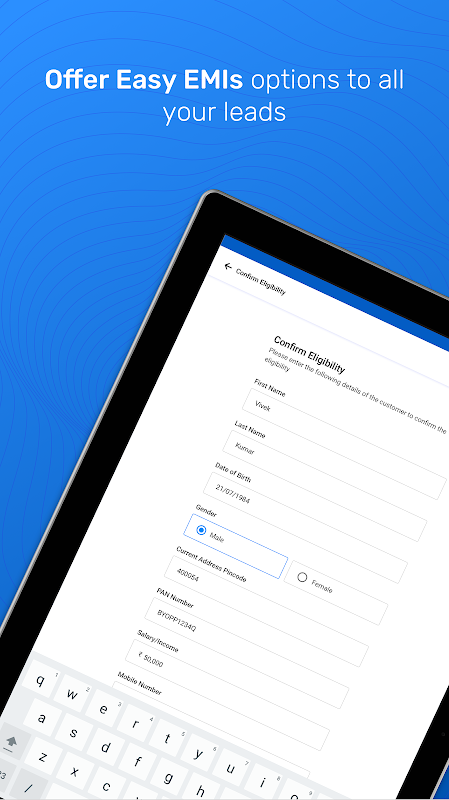

Easy Loan Application Process: The app offers a seamless and hassle-free loan application process. Users can quickly and easily apply for a personal loan or financing option without the need for a bureau score or credit card.

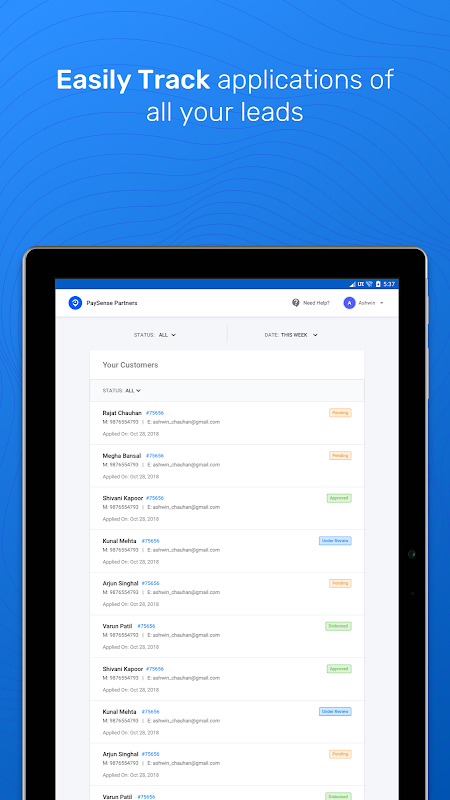

Fast Approval and Disbursement: With PaySense, users can get instant approval for their loan applications, and the funds are disbursed quickly. This ensures that customers can access the money they need in a timely manner.

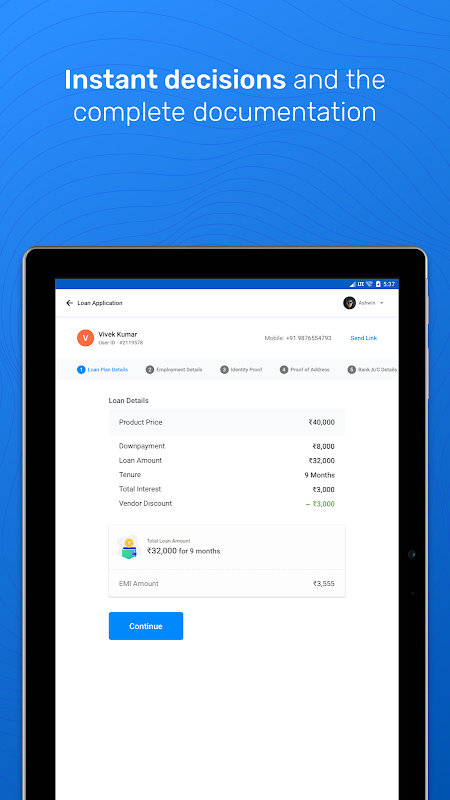

Wide Range of Loan Amounts: PaySense provides personal loans ranging from ₹5000 to ₹500,000. This allows users to borrow the exact amount they need, making it convenient for various purposes such as medical emergencies, education expenses, wedding costs, and more.

Flexible Repayment Options: The app offers flexible repayment options, allowing users to choose a loan tenure ranging from 3 months to 60 months. This flexibility ensures that borrowers can repay the loan at their own pace and convenience.

Tips for Users:

Complete the Loan Application Accurately: To increase the chances of loan approval, ensure that all the information provided in the application is accurate and up-to-date. This includes personal details, financial information, and employment history.

Submit Required Documents Promptly: PaySense requires certain documents for loan verification. To speed up the loan approval process, it is advisable to submit all the necessary documents promptly and correctly.

Choose an Appropriate Loan Amount: Before applying for a loan, evaluate your financial needs and borrow only the required amount. Avoid taking a loan that exceeds your repayment capacity, as it may lead to financial stress in the future.

Set Up Automatic Repayments: To avoid missing loan repayments and incurring additional charges, set up automatic repayments through the app. This ensures that the EMIs are deducted from your bank account on the specified due dates.

Conclusion:

The app provides a seamless experience, ensuring that customers can access the funds they need quickly. With playing tips such as completing the loan application accurately, submitting required documents promptly, choosing an appropriate loan amount, and setting up automatic repayments, users can make the most of PaySense Partner and meet their financial needs effectively.