Introducing UKU - Pinjaman Dana Digital, the hassle-free digital loan app. With UKU, you can get a safe and reliable loan from an information technology-based joint funding service platform that is licensed and supervised by the OJK. UKU is committed to providing trusted services, evident through its permits from the OJK and membership in AFPI. Rest assured, your information is secure with UKU's ISO/IEC 27001:2013 certification. Plus, borrowing funds from UKU is easy and transparent. Simply provide your personal details, fill in the form, and get the funds within 24 hours. Repayments are convenient with various methods available. Say goodbye to loan worries with UKU!

Features of UKU - Pinjaman Dana Digital:

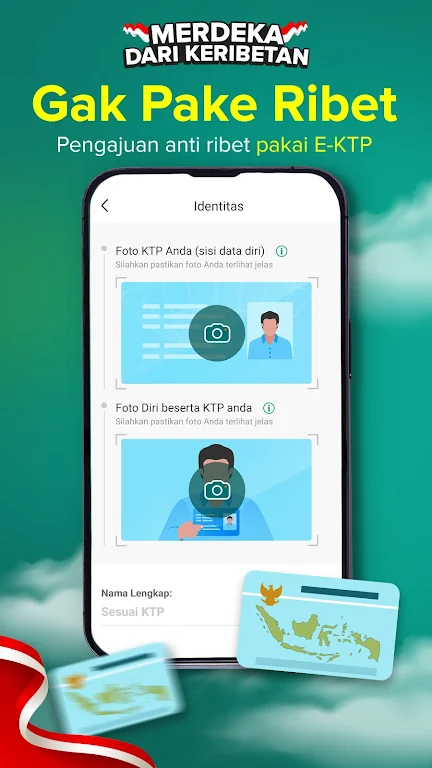

- Hassle-free loan application process: With UKU, you can easily apply for a loan by providing your KTP, personal account number, active cellphone number, and filling out the application form in the app. No unnecessary paperwork or complicated procedures.

- Transparent fee structure: UKU is committed to providing transparent services to its customers. There are no hidden fees, and the maximum service charge will not exceed 14% per year. This ensures that you have a clear understanding of the costs involved.

- Flexible loan options: UKU offers loan periods ranging from 90 to 180 days, allowing you to choose the repayment term that suits your needs. The maximum annual interest (APR) is 36%, providing reasonable borrowing options.

- Fast fund disbursement: Once your loan application is approved and verified, UKU ensures that the cash funds are disbursed to your registered account within a maximum of 24 hours. This quick disbursement process ensures that you can access the funds when you need them.

Tips for Users:

- Provide accurate and up-to-date information: To expedite your loan application process, make sure to provide accurate and up-to-date information. This will help in the verification process and ensure a smooth loan disbursement.

- Choose the right loan period: Consider your financial situation and choose a loan period that allows you to comfortably repay the borrowed amount. Longer loan periods may have lower monthly installments but could result in higher overall interest charges.

- Set a budget for repayment: Before taking a loan, create a budget to ensure that you can comfortably repay the borrowed amount. This will help you avoid any financial strain and ensure timely repayments.

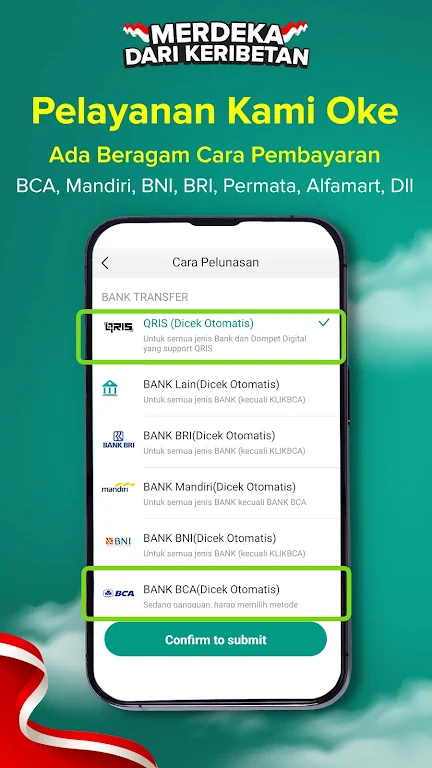

- Explore repayment options: UKU offers various easy repayment methods, including ATM transfer, M-Banking, QRIS, and Alfa Group. Choose the repayment method that is most convenient for you and make your repayments on time to maintain a good borrowing experience.

Conclusion:

UKU - Pinjaman Dana Digital is a safe and reliable loan provider that offers a hassle-free loan application process, transparent fees, flexible loan options, and fast fund disbursement. With a focus on security and customer satisfaction, UKU ensures that your loan application and borrowing experience are smooth and convenient. By providing accurate information, choosing the right loan period, setting a repayment budget, and utilizing the various repayment options, you can maximize your experience with UKU and benefit from their trusted services. Borrow funds with confidence from UKU and fulfill your financial needs today.