Introducing the Marcus - Savings & Loans app, your all-in-one solution for managing your finances. With just a few taps, you can access your savings accounts, certificates of deposit, and personal loans from Marcus by Goldman Sachs®. This user-friendly app offers a range of features, from checking your balances and tracking your progress to making transfers and payments. The app even supports fingerprint or facial recognition for added security and convenience. Whether you want to grow your savings or manage your loan, the Marcus app has got you covered. Download now and see how easy it is to make the most of your money. Available exclusively for U.S. based accounts.

Features of Marcus - Savings & Loans:

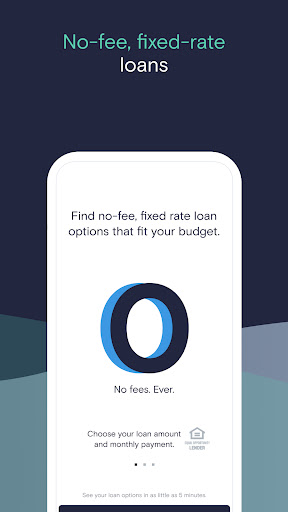

- Convenient Access to Financial Products: The Marcus app offers users fast and easy access to a range of financial products, including savings accounts, CDs, and personal loans. With just a few taps, users can manage their money on the go.

- Money Growth Opportunities: With the Marcus app, users can schedule and track deposits and withdrawals, as well as manage the maturity of their certificates of deposit. The app also provides the option to automate savings through recurring transfers, helping users grow their money effectively.

- Comprehensive Financial Tracking: The app allows users to review recent savings transactions, track transfers, and even calculate how much interest they have earned throughout the year. Additionally, users can conveniently access monthly statements and tax documents, providing a comprehensive overview of their financial activities.

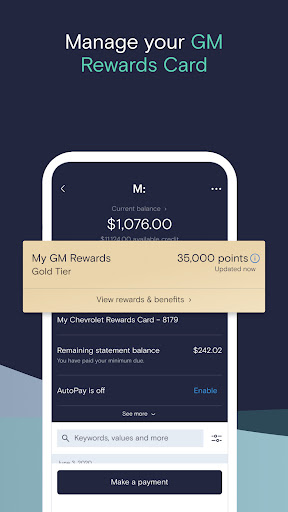

- Loan Management Made Easy: For users with Marcus Personal Loans, the app offers features to manage their loans effortlessly. Users can check their remaining loan balance, make payments, schedule future payments, and even enroll in and manage AutoPay.

Tips for Users:

- Take Advantage of Automated Savings: To maximize your savings, make use of the app's recurring transfer feature. By automating your savings, you can consistently set aside money without even thinking about it.

- Regularly Check Your Progress: Utilize the app's ability to track your transfers and review savings transactions. By regularly checking your progress, you can stay motivated and make adjustments to your financial strategy as needed.

- Optimize Loan Repayments: Keep track of your payments and observe the breakdown of principal versus interest. This information can help you strategically plan your loan repayment strategy and potentially save money on interest payments.

Conclusion:

The Marcus - Savings & Loans app simplifies banking and allows users to efficiently manage their money. With features like convenient access to financial products, money growth opportunities, comprehensive financial tracking, and easy loan management, the app offers a comprehensive and user-friendly experience. By taking advantage of automated savings, regularly monitoring progress, and optimizing loan repayments, users can make the most of their financial resources. Experience the convenience and efficiency of the Marcus app today and take control of your finances.