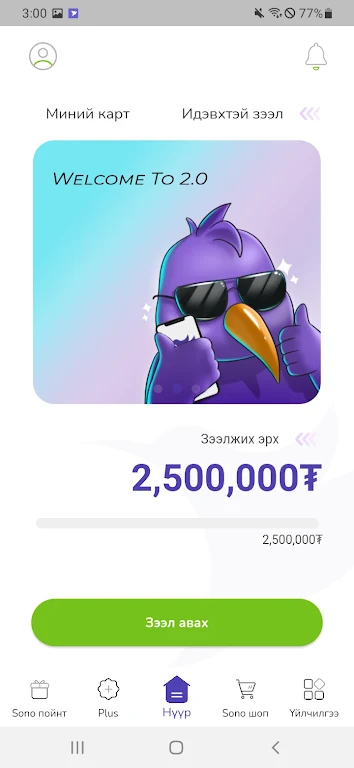

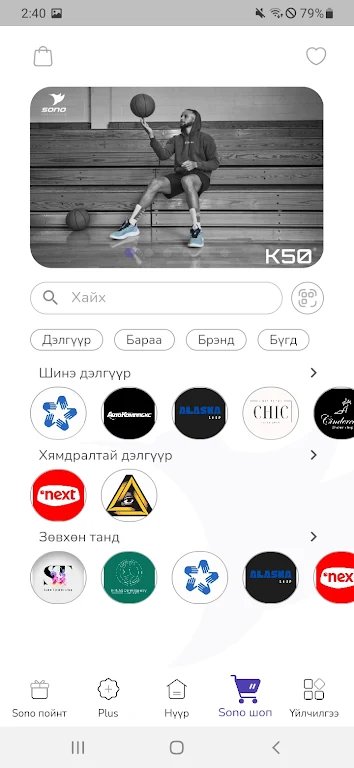

Introducing Sono Mongolia, the innovative fintech app that makes getting a loan easier than ever before. Whether you need some extra cash for an emergency or want to make a big purchase, SONO has you covered. With its user-friendly interface, all you have to do is download the app, register your information, and choose the loan type that suits your needs. The best part? SONO offers a variety of loan options, from unsecured loans to zero interest loans, so you can find the perfect fit for your financial situation. Plus, with flexible repayment terms and low APR, you can borrow with confidence. Stop stressing about money and start using SONO today!

Features of Sono Mongolia:

- Convenience: The SONO loan application allows users to easily apply for loans using just their smartphones, eliminating the need to visit a physical branch or go through extensive paperwork. This convenient process saves users time and effort.

- Range of Loan Types: The SONO loan application offers various loan types to cater to different needs. Users can choose from unsecured loans, purchase loans, ZERO ZERO loans, and e-loans. This flexibility ensures that users can find the loan type that best suits their specific requirements.

- Loan Amount Flexibility: With the SONO loan application, users have the freedom to choose their preferred loan amount. Users can borrow an amount that aligns with their financial needs and repayment capabilities.

- Security and Privacy: SONO FINTEK NBFI LLC operates in accordance with Mongolian laws and international regulations to ensure the security and privacy of users' personal information. Users can trust that their data is stored securely and handled with utmost confidentiality.

Tips for Users:

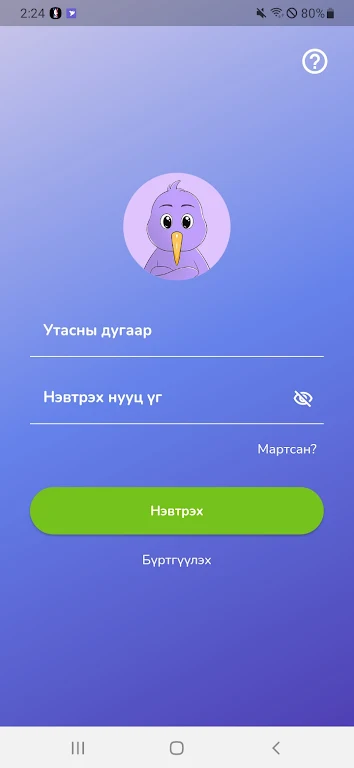

- Complete Registration: Start by downloading the SONO application and registering your user information. Make sure to provide accurate details and verify your phone number to proceed with loan applications.

- Provide Comprehensive Information: When applying for a loan, make sure to provide all the necessary information accurately. This includes personal details, financial information, and any other requested documents. Providing comprehensive and accurate information can increase the chances of loan approval.

- Understand Loan Terms: Before signing any loan agreements, take the time to thoroughly understand the loan terms. Familiarize yourself with the repayment period, interest rates, and any additional fees. This will ensure that you can plan your finances accordingly and avoid any surprises during the repayment period.

Conclusion:

The Sono Mongolia application offers a convenient and user-friendly platform for individuals in Mongolia to access e-loan services. With its easy-to-use interface, users can apply for different types of loans and choose their preferred loan amount. The application prioritizes the security and privacy of users' personal information, providing peace of mind throughout the loan process. By following the playing tips, users can navigate the application smoothly and maximize their borrowing experience. Whether you need a loan for personal expenses or to make a purchase, SONO is a reliable and efficient solution. Download the app today and experience the benefits of hassle-free lending.