Stay on top of your finances no matter where you are with the DSK Smart app. This mobile application from DSK Bank allows you to conveniently and easily manage your accounts and transactions while on the go. With DSK Smart, you can access information about your funds and transactions, transfer money between your accounts, pay bills, make transfers to third parties, and even apply for credit products like a credit card or consumer loan. You can also change card limits, find the nearest banking offices and ATMs, book a consultation, and stay updated on exchange rates. Take control of your finances with DSK Smart.

Features of DSK Smart:

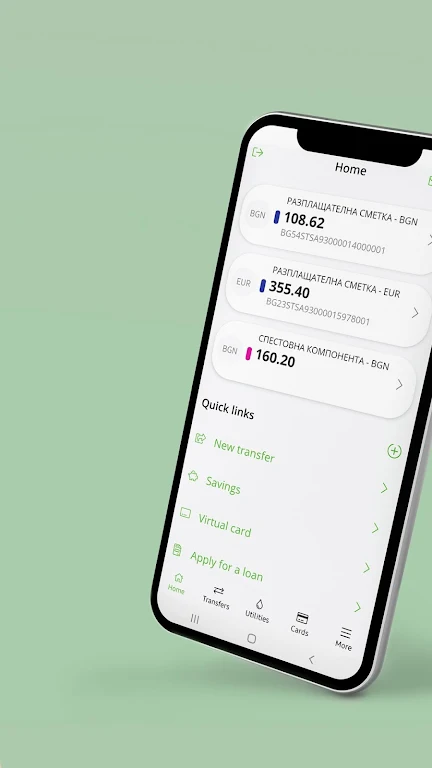

❤ Access to Account Information:

With the DSK Smart app, users can easily access information about their funds and transactions. This allows them to keep track of their finances even when they are on the go.

❤ Fund Transfers:

Users can transfer funds between their own accounts using the app. This makes it easier and more convenient to manage their money and make payments.

❤ Bill Payments:

The app allows users to pay their utility bills with just a few taps on their mobile devices. This eliminates the need to visit physical bank branches or use other payment methods.

❤ Transfers to Third Parties:

Users can also make transfers to third parties using the DSK Smart app. This feature is especially useful for sending money to friends, family, or business partners.

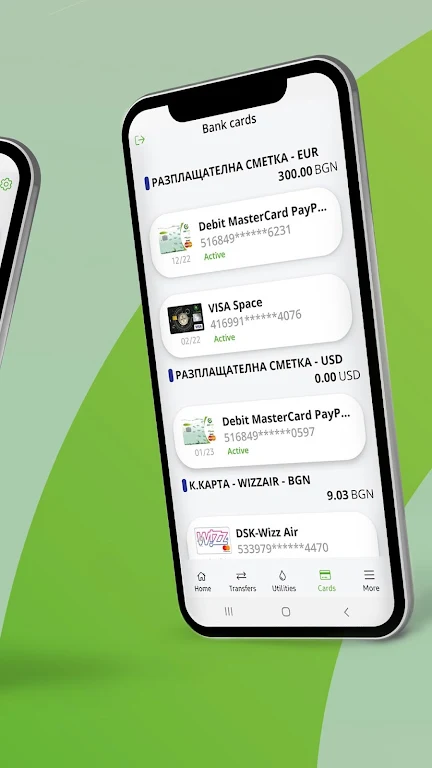

❤ Credit Product Applications:

The app offers users the ability to apply for various credit products, such as credit cards, consumer loans, or overdrafts. This makes it easier to access credit and manage financial needs.

❤ Convenient Banking Services:

The DSK Smart app provides users with convenient access to the bank's contact channels, including a feedback form, email, and phone. Users can easily reach out to the bank for any inquiries or assistance.

Tips for Users:

❤ Stay Informed:

Regularly check the app for updated information about your funds and transactions. This will help you stay on top of your finances and make informed decisions.

❤ Set Reminders:

Use the app's features to set reminders for bill payments and other important financial obligations. This will help you avoid late payments and potential penalties.

❤ Explore Credit Options:

Take advantage of the app's credit product application feature to explore different credit options available to you. Compare terms and conditions to make an informed decision.

❤ Use Convenient Banking Channels:

Utilize the app's convenient contact channels to reach out to the bank for any inquiries or assistance. This will help you resolve any issues quickly and efficiently.

Conclusion:

The app offers a wide range of features that make banking more convenient and accessible for users. From accessing account information to transferring funds and applying for credit products, the app provides a comprehensive set of tools for managing finances on the go. With the added convenience of bill payments, transfers to third parties, and easy access to banking services, users can stay in control of their finances and make informed decisions. Download the app today and experience a smarter way to bank.