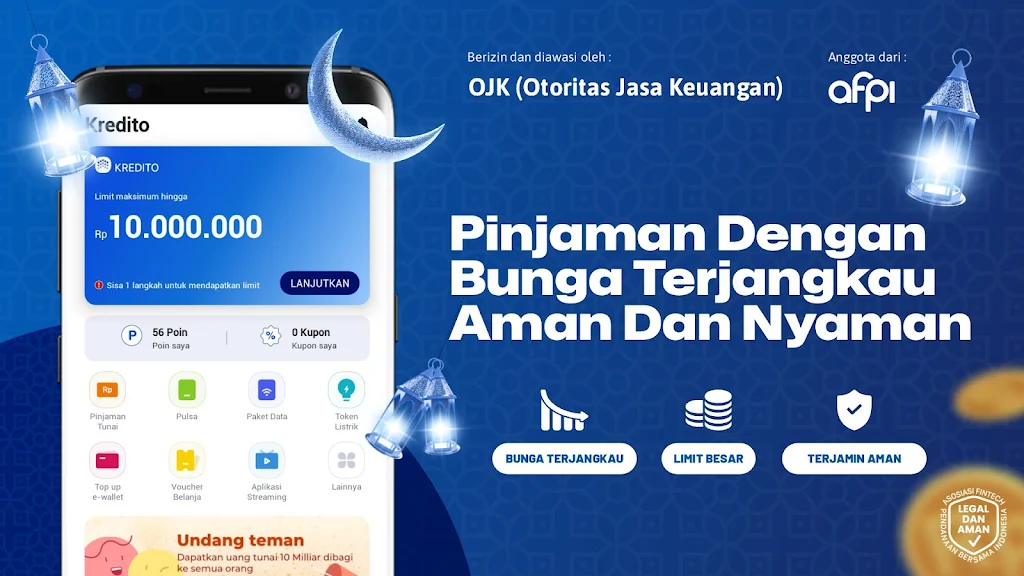

Looking for a convenient and secure way to borrow cash without collateral? Look no further than Kredito—Pinjaman Uang Online, the leading online cash loan platform that is licensed and supervised by the OJK. With Kredito, you can borrow up to IDR 10,000,000 easily and safely, without worrying about providing collateral. We prioritize the protection of your personal privacy data, ensuring a worry-free loan experience. Using our innovative algorithm technology and big data analysis, we provide a quick verification process and swift fund disbursement, making it easier than ever to get the financial assistance you need. Don't let financial constraints hold you back, download Kredito now and start your hassle-free loan application today.

Features of Kredito—Pinjaman Uang Online:

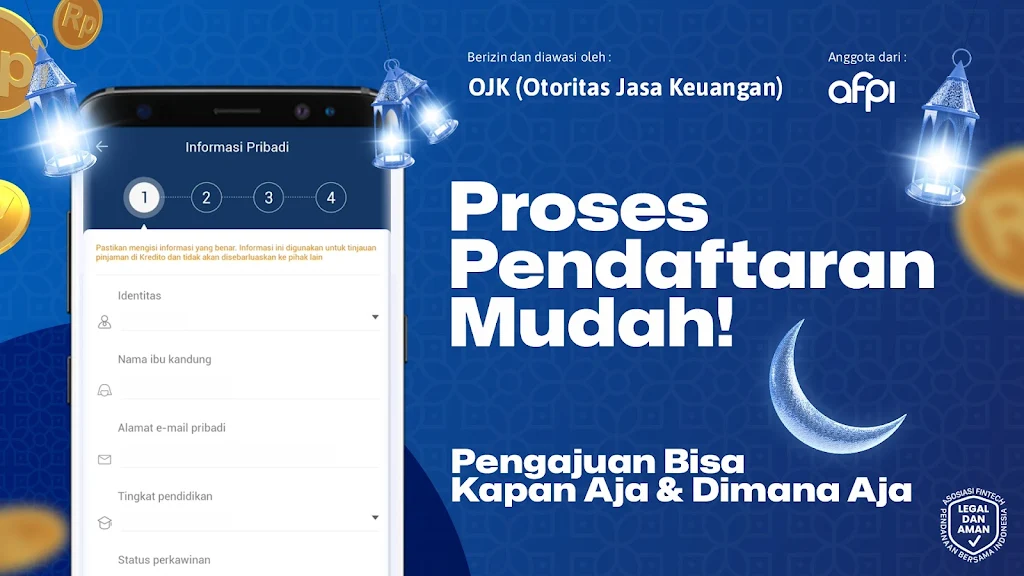

Easy and Convenient Application Process: With Kredito, you can apply for a cash loan easily and conveniently. All you need to do is download the Kredito app from the Google Play Store and complete your personal data. The whole process can be done from the comfort of your own home, saving you time and effort.

Quick Fund Disbursement: Once your loan application is verified and approved, the funds will be disbursed quickly to your designated bank account. This means that you can have access to the cash you need in a short amount of time, allowing you to address your financial needs promptly.

No Collateral Required: Kredito offers cash loans without the need for collateral. This means that you don't have to worry about providing any valuable assets as security for your loan. This makes the loan application process simpler and more accessible to a wider range of individuals.

Competitive Interest Rates and Fees: Kredito provides loans with affordable interest rates and service fees. This ensures that you can borrow the funds you need without incurring excessive expenses. The transparent pricing structure allows you to make informed decisions and manage your finances effectively.

FAQs:

How much can I borrow from Kredito?

- You can borrow up to IDR 10,000,000 from Kredito. The loan amount will depend on your individual circumstances and creditworthiness.

Is Kredito licensed and regulated?

- Yes, Kredito is licensed and supervised by the OJK (Otoritas Jasa Keuangan) with registration number KEP-47/D.05/ This ensures that the platform operates in compliance with the necessary regulations and guidelines, providing you with a secure and trustworthy lending experience.

How long is the repayment period for Kredito loans?

- The repayment period for Kredito loans ranges from a minimum of 91 days to a maximum of 360 days. You can choose a loan term that suits your needs and financial capabilities.

Conclusion:

With Kredito—Pinjaman Uang Online, you have access to an online cash loan platform that offers a range of attractive features. The easy and convenient application process, quick fund disbursement, and no collateral requirement make it a hassle-free borrowing option. Additionally, the competitive interest rates and fees ensure that you can manage your finances effectively while borrowing the funds you need. Kredito's commitment to regulatory compliance and financial inclusion further enhances its credibility as a leading and trusted financial technology company. Download Kredito now to experience a secure and hassle-free loan application process.