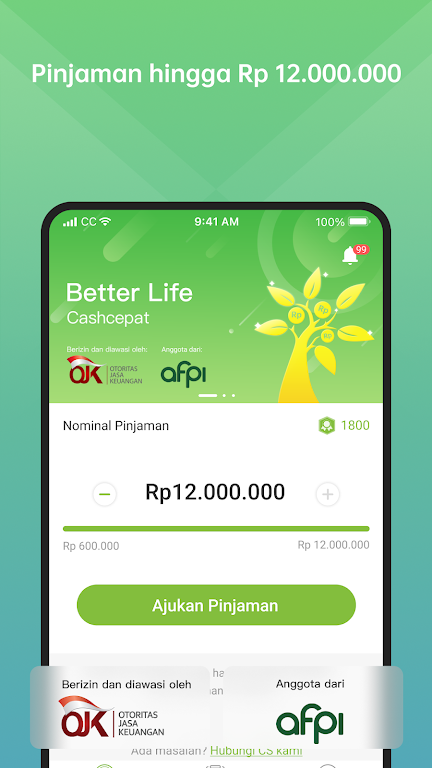

Cashcepat- Pinjaman Tunai is a game-changing app that provides fast and convenient cash loans to general consumers in Indonesia. With a permit and supervision from the Financial Services Authority, this IT-based lending and borrowing platform offers a secure and regulated solution for those in need of quick funds. Whether you're facing an unexpected expense or simply need some extra cash, Cashcepat has you covered. With loan amounts ranging from 500 thousand to 10 million Rupiah and a maximum APR of 36% per year, you can easily access the funds you need to bridge the gap. Simply download the app from the Google Play Store, fill in the necessary information, and wait for our quick verification and analysis process. Say goodbye to long waits and complex paperwork - Cashcepat is here to make your financial life easier.

Features of Cashcepat- Pinjaman Tunai:

* Easy and Convenient: Cashcepat offers a user-friendly and efficient lending platform, making it quick and convenient for Indonesian consumers to access fast funds in the local currency. With just a few simple steps, users can apply for a loan and receive the funds they need.

* Lower Overall Costs: Recent updates to Cashcepat have resulted in lower overall costs for users. This means that borrowers can enjoy more affordable loan options, allowing them to meet their financial needs without excessive charges or fees.

* Secure and Regulated: Cashcepat is a licensed and regulated application supervised by the Financial Services Authority (OJK). This ensures that users can trust the platform with their personal and financial information, providing a safe and secure borrowing experience.

* Wide Loan Range: Cashcepat offers loans ranging from 500 thousand to 10 million Rupiah, providing flexibility for borrowers to choose the loan amount that best suits their needs. This range caters to a variety of financial situations, making Cashcepat accessible to a wide range of Indonesian consumers.

Tips for Users:

* Fill in Accurate Information: When applying for a loan on Cashcepat, ensure that all personal and financial information provided is accurate and up-to-date. This will help streamline the verification and analysis process, increasing the chances of approval and faster loan disbursement.

* Choose a Suitable Tenor: Cashcepat offers a tenor range of 61 to 180 days. It is advisable to carefully consider your repayment capabilities and select a tenor that aligns with your financial situation. This will help ensure timely repayment and avoid any unnecessary penalties or charges.

* Understand Total Funding Fees: Familiarize yourself with the total funding fees associated with your loan amount and tenor. A simulation of payment is provided by Cashcepat, allowing borrowers to calculate the total cost of their loan. Being aware of these fees will help you plan and manage your finances effectively.

Conclusion:

Cashcepat- Pinjaman Tunai is a reliable and efficient lending application that offers attractive features for Indonesian consumers in need of fast funds. With its easy and convenient platform, lower overall costs, secure regulations, and wide loan range, Cashcepat provides a user-friendly experience for borrowers. By following the playing tips of providing accurate information, selecting a suitable tenor, and understanding the total funding fees, users can maximize the benefits of Cashcepat and effectively manage their loan repayments. Download the latest version of Cashcepat from the Google Play Store and enjoy the benefits of this trusted lending platform.