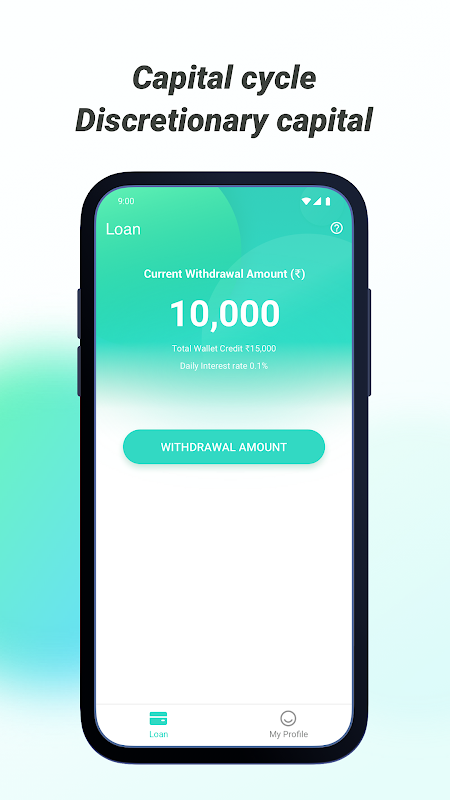

Introducing MoMo, the ultimate solution for all your financial needs! With MoMo, you can say goodbye to the stress of dealing with cash crunches. This innovative app offers a revolving credit product that allows you to borrow and repay at your convenience. Whether you need ₹3,000 or ₹30,000, it has got you covered. The best part? There's no limit on the number of loans you can take in 60 days! Plus, with a quick and easy sign-up process, you can create your profile in minutes and get your loan approval status in no time. Once approved, you can borrow any amount from your credit limit and have it transferred directly to your bank account. No more waiting around! The app also offers flexible repayment options, making it incredibly convenient for you. And with features like immediate bank transfers and secure transactions, you can rest assured that your financial transactions are safe and secure. It is also backed by excellent customer service, so you can always rely on their support whenever you need it.

Features of MoMo:

> Payback and Use Again Immediately: The app offers the convenience of revolving credit, allowing users to borrow and repay at any time. This means that once you repay your loan, you can immediately borrow again, without any waiting time or hassle.

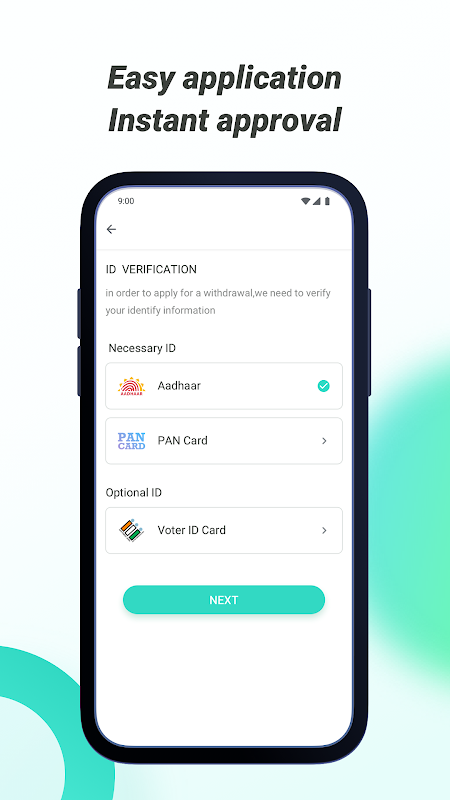

> 100% Online Process: With MoMo, you can complete the entire loan application process online, eliminating the need for tedious paperwork and long waiting periods. Simply download the app, register/login with your phone number, and provide the required information and documents.

> Fast Approval: The app believes in providing fast and efficient service to its users. After submitting your application, you can expect to receive your approval status within a short review period, ensuring you get the funds you need quickly.

> Easy and Flexible Repayment Options: The app understands that everyone's financial situation is different. That's why they offer easy and flexible repayment options, allowing you to repay your loan in a way that suits you best. Whether you prefer to make partial repayments or repay the full amount before the due date, it has got you covered.

Tips for Users:

> Sign Up in Seconds: Getting started with MoMo is quick and easy. Simply sign up in seconds by downloading the app from the Google Play store and register/login with your phone number. This will allow you to access all the features and benefits MoMo has to offer.

> Complete Your Profile in Minutes: To increase your chances of getting approved for a loan, make sure to complete your profile with accurate and up-to-date information. This includes providing the required KYC documents, such as your identity proof and bank statements.

> Apply for a Loan and Get Approval Status After a Review: Once your profile is complete, you can apply for a loan directly through the app. After a quick review process, you will receive your approval status, letting you know whether your loan has been approved.

> Borrow Any Amount from Your Credit Limit: Once your loan is approved, you can borrow any amount from your credit limit. This means you can access the funds you need without any restrictions, giving you financial flexibility and peace of mind.

Conclusion:

MoMo is the ideal app for those who need quick and convenient access to credit. With features like payback and use again immediately, 100% online process, and fast approval, MoMo ensures a seamless experience for its users. The app offers easy and flexible repayment options, making it suitable for individuals with different financial circumstances. With the app, you can say goodbye to cash crunches and enjoy the benefits of immediate bank transfers and secure transactions. So, why wait? Download now and experience the perks of revolving credit at your fingertips.