October is a game-changing app that puts your savings right at your fingertips! With October, lending money directly to small and medium-sized businesses in France, Spain, Italy, or the Netherlands has never been easier. Starting from just €20 per loan, you can now take control of your finances and support local enterprises. This user-friendly app allows you to receive instant notifications as soon as a new project is available, lend money directly from your phone, keep track of your monthly payments, access your loan portfolio, add funds, and even ask questions to the dedicated October team. However, keep in mind that investing in SMEs comes with risks, such as potential loss of capital, so be sure to make informed decisions before locking in your savings. The app is here to make your savings work for you and empower you to support small businesses like never before!

Features of October:

⭐ Easy Access to Investment Opportunities:

With the app, you can conveniently lend directly to small and medium-sized businesses from your phone. This provides you with an excellent opportunity to invest in promising projects and contribute to the growth of local economies.

⭐ Timely Notifications:

Never miss out on a new project by receiving instant notifications on your mobile. As soon as a new opportunity is available, you'll be alerted, allowing you to stay ahead of the competition and secure your investment.

⭐ User-Friendly Interface:

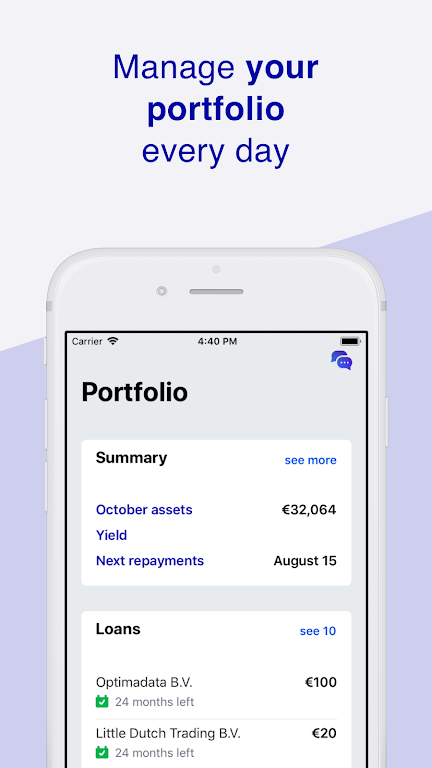

The app is designed with user convenience in mind. Its intuitive interface makes lending money and managing your loan portfolio hassle-free. Whether you're a seasoned investor or new to the lending market, you'll find the app easy to navigate and use.

⭐ Transparent Tracking:

Stay on top of your monthly payments with the tracking feature provided by the app. You'll be able to monitor the progress of your loans and ensure a timely return on your investments. This transparency allows for better financial planning and peace of mind.

FAQs:

⭐ Is my investment safe?

While October provides an excellent opportunity for growth, it's important to acknowledge that lending money to small and medium-sized businesses carries some risk. There is a possibility of losing your capital, so make sure to perform due diligence on the projects you invest in and assess their viability.

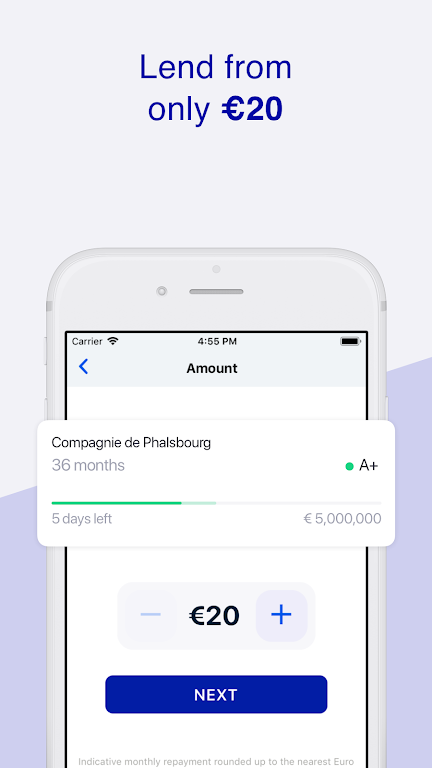

⭐ How much can I lend?

You can lend as little as €20 per loan through the app. This flexible investment option allows you to diversify your portfolio and minimize risk.

⭐ Can I add funds and withdraw from my account easily?

Yes, the app provides the convenience of adding funds to your account and debiting them as needed. This makes it simple for you to manage your investment and react quickly to new opportunities.

Conclusion:

With the October app, investing in small and medium-sized businesses has never been easier. Its user-friendly interface and timely notifications ensure that you don't miss out on promising projects. The transparent tracking feature allows you to monitor your investments, while the flexibility to lend as little as €20 per loan gives you the freedom to diversify your portfolio. However, it's important to remember that lending to SMEs carries a risk of capital loss, so make sure to thoroughly evaluate the projects before investing. Download the app today to start growing your savings and supporting local businesses.