NZ Tax Calculator - New Zealand Income Tax PAYE is a must-have app for anyone living and working in New Zealand. With just a few simple inputs, this app calculates exactly how much money you'll receive in your bank account from your salary or wages after all deductions are made. From income tax to ACC levies, employee Kiwisaver contributions to student loan deductions, this app covers it all. What sets it apart is its intelligent detection of your appropriate tax rate, ensuring that you receive an accurate result of how much take-home pay you can expect. Take control of your finances with the NZ Tax Calculator app today.

Features of NZ Tax Calculator - New Zealand Income Tax PAYE:

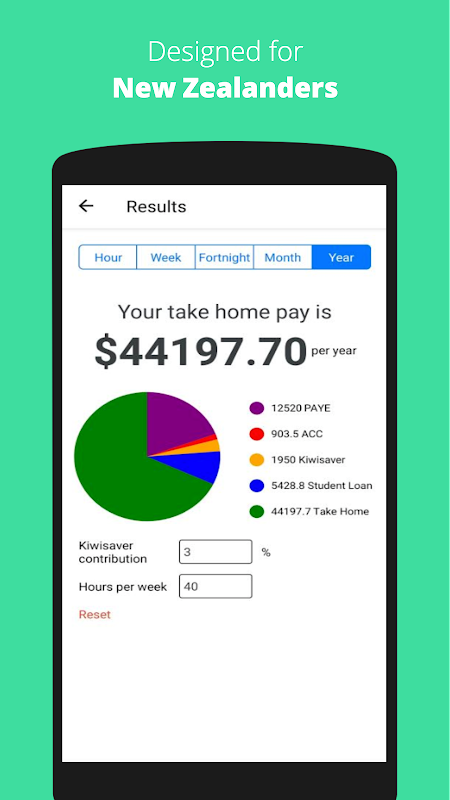

⭐ Accurate Calculation: NZ Tax Calculator is a reliable tool that accurately calculates the amount of money you should receive in your bank account after deductions. It considers all the required deductions as per New Zealand Law, including Income Tax, ACC Levy, Employee Kiwisaver Contributions, and Student Loan Deductions. With a few simple inputs, you can quickly determine your take-home pay.

⭐ Easy-to-Use Interface: The app offers a user-friendly interface, making it easy for anyone to navigate and understand. The input fields are clear and intuitive, allowing you to enter your salary or wages effortlessly. You don't need to be a tax expert to use this app – it simplifies the tax calculation process for everyone.

⭐ Smart Tax Rate Detection: NZ Tax Calculator intelligently detects your appropriate tax rate, ensuring accurate calculations. It takes into account the latest tax brackets and rates, so you can be confident that the results provided by the app are up to date and reflect the current tax regulations in New Zealand.

⭐ Time and Money Savings: By using NZ Tax Calculator, you can save valuable time and money. Instead of manually calculating your take-home pay or relying on potentially confusing online calculators, this app streamlines the process for you. It eliminates the risk of errors and provides you with an instant result, allowing you to plan and budget more efficiently.

Tips for Users:

⭐ Input Correct Information: To ensure accurate calculations, make sure to input the correct information about your salary or wages and any applicable deductions. Double-check your entries before proceeding.

⭐ Stay Updated with Tax Changes: Tax rates and regulations can change, so it's essential to stay informed about any updates that may affect your take-home pay. The NZ Tax Calculator app takes care of this for you by automatically considering the latest tax brackets and rates.

⭐ Explore Different Scenarios: Use the app to explore different scenarios based on potential changes in your salary, deductions, or employment conditions. This will help you make informed decisions and plan your finances accordingly.

Conclusion:

NZ Tax Calculator - New Zealand Income Tax PAYE is a must-have app for anyone living and working in New Zealand. It offers accurate and up-to-date calculations, taking into account all the necessary deductions required by law. With its user-friendly interface and intelligent tax rate detection, the app simplifies the tax calculation process and saves you time and money. Whether you want to budget effectively, negotiate a salary increase, or understand your take-home pay, this app provides the essential information you need. Download NZ Tax Calculator now and take control of your financial planning with ease.