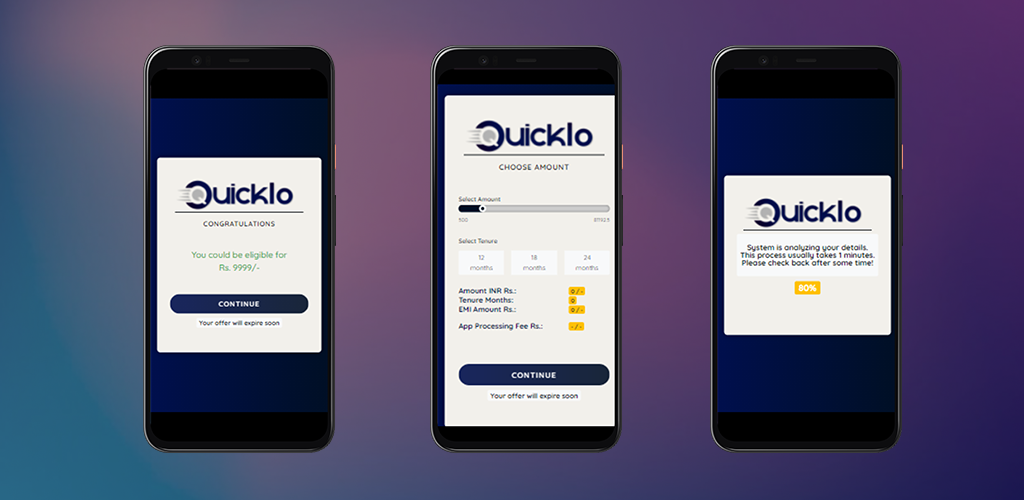

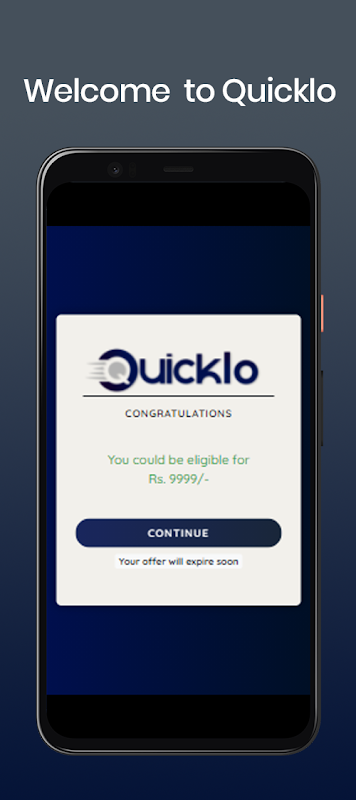

Introducing Quicklo, the app that makes applying for a loan quick, easy, and hassle-free. With Quicklo, you can borrow up to Rs 2,00,000 with low-interest rates of up to 24% APR. Plus, the app processing fee is a flat rate of INR Rs. 399 (maximum), making it affordable for everyone. Whether you need the loan for marriage expenses, car and two-wheeler purchases, education, medical emergencies, or any other purpose, Quicklo has got you covered. The app also offers flexible loan repayment terms and a fast processing time, with same-day audits and eligibility checks done 100% online. To check your eligibility, simply install the app, register, and provide the necessary KYC documentation. Rest assured, all transactions are secured with SSL encryption, and your personal information will never be shared without your explicit permission.

Features of Quicklo:

> High loan amount: With this app, you can apply online for loans up to Rs 2,00,000. This high loan amount ensures that you can meet your financial needs, whether it's for a major expense or an emergency situation.

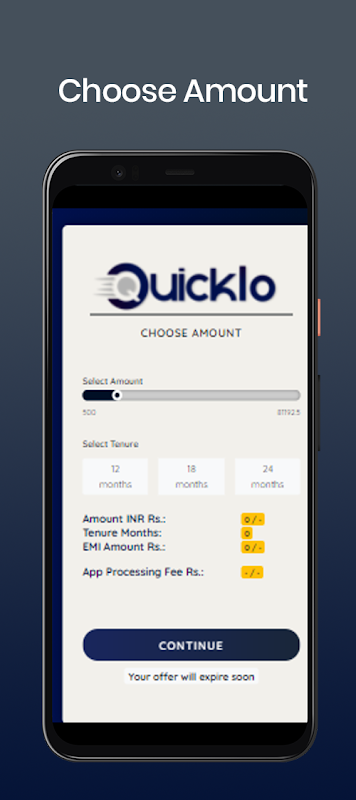

> Low-interest rates: The app offers low-interest rates, with a maximum Annual Percentage Rate (APR) of 24%. This means that you can borrow money without worrying about exorbitant interest charges, making it easier for you to repay the loan.

> Transparent processing charges: The app processing charge for Quicklo is a flat INR Rs. 399 (maximum), plus applicable taxes at 18% GST. This transparent fee ensures that you know exactly how much you will be charged, allowing you to plan your finances accordingly.

> Flexible loan term: The app offers flexible loan repayment terms, ranging from 120 days to 720 days. This allows you to choose a loan term that suits your financial situation and helps you repay the loan comfortably.

Tips for Users:

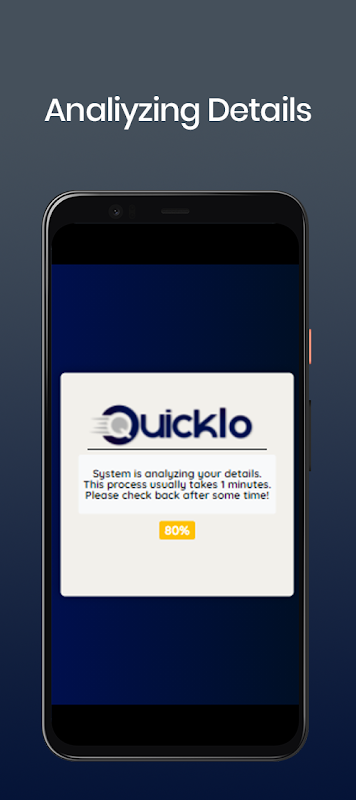

> Check eligibility instantly: The app provides a quick and easy way to check your eligibility for a loan. Simply install the app, register, and check your eligibility instantly. This saves you time and helps you determine if you qualify for a loan without any hassle.

> Provide necessary documentation: To proceed with the loan application, the app requires KYC documentation, including identity proof (Aadhar/PAN/VoterID) and address proof (Aadhar/Utility bills/Rental Agreement). Make sure to have these documents ready to expedite the loan process.

> Explore options through app consulting: The app acts as a consultant and connects you to the best players in the market. Once you have checked your eligibility, the app provides an idea about your possible eligibility and connects you to suitable loan options. Consider these options and choose the one that best fits your needs.

Conclusion:

Whether you need funds for a major expense, medical emergencies, education, or any other purpose, this app has you covered.By following a few simple steps, such as checking your eligibility instantly, providing the necessary documentation, and exploring loan options through app consulting, you can quickly and efficiently secure the loan you need. Download this app today and experience the ease and convenience of accessing loans up to Rs 2,00,000 with low-interest rates and transparent charges.