Introducing SRFC Hr Shri Ram Finance, an innovative app designed to provide financial support to individuals residing in rural and semi-urban areas. With a focus on reaching remote locations where traditional banks are inaccessible, this app offers a range of finance solutions that improve the quality of life for these communities. With the backing of a licensed non-deposit taking NBFC, this Raipur Chhattisgarh based company has been providing asset financing for two-wheelers since 2003. Over the years, they have expanded their services to include four-wheeler finance, small and medium enterprise loans, and microfinance institution loans. With a wide network of branches, service centers, and dealers in Chhattisgarh, Madhya Pradesh, and Odisha, SRFC Hr Shri Ram Finance is revolutionizing access to financial services for those in need.

Features of SRFC Hr:

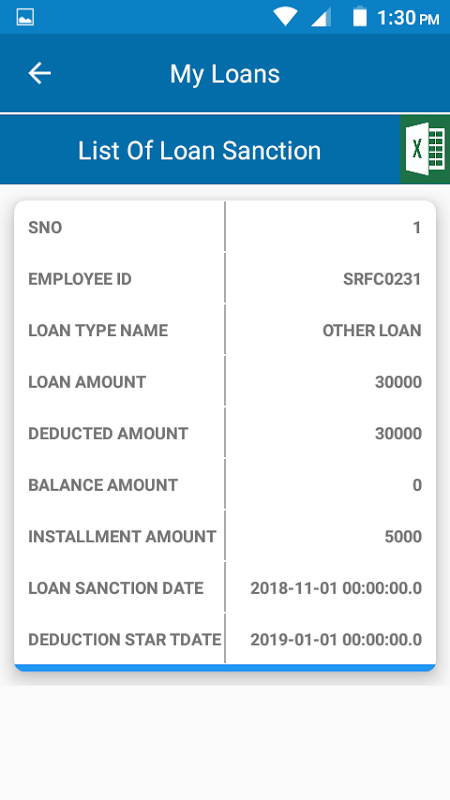

Convenient Loan Application Process: The SRFC Hr Shri Ram Finance App offers a hassle-free loan application process. Users can easily apply for loans from their mobile devices, eliminating the need to visit a physical branch or fill out extensive paperwork.

Multiple Loan Options: The app provides various loan options to cater to different financial needs. Whether users require a two-wheeler loan, four-wheeler finance, small medium enterprises loan, or microfinance institution loan, they can find suitable options within the app.

Wide Network Coverage: SRFC Hr Shri Ram Finance operates with a vast network of over 115 branches, 45 service centers, and 600 dealers. This extensive coverage ensures that users can access the services and support they need, even in remote areas.

Rural Focus: The company specializes in serving rural and semi-urban areas, ensuring that individuals in these regions can receive financial support. The app is designed to cater specifically to the needs and challenges faced by rural customers, making it a reliable financial solution.

Tips for Users:

Explore Loan Options: Take the time to understand the different loan options available within the SRFC Hr Shri Ram Finance App. Each loan type may have specific eligibility criteria and repayment terms, so carefully consider which loan suits your needs best.

Complete Applications Accurately: When applying for a loan through the app, ensure that you provide accurate and complete information. Any discrepancies or missing details could delay the loan approval process.

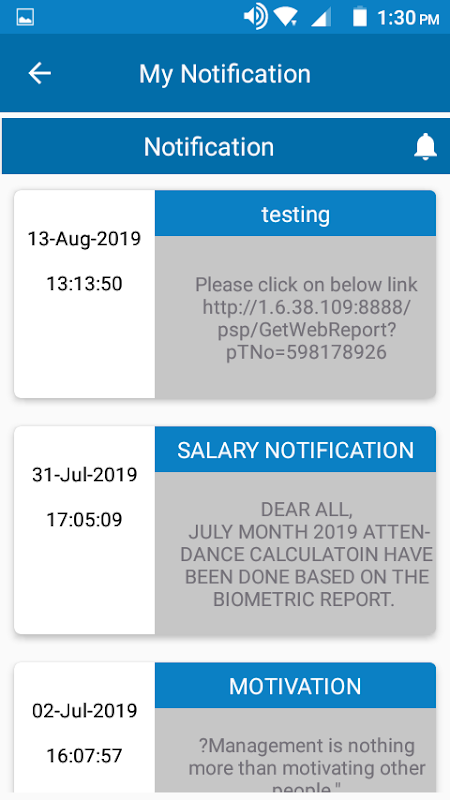

Utilize Customer Support: If you have any questions or need assistance, make use of the customer support provided by SRFC Hr Shri Ram Finance. They can help clarify any doubts and guide you through the loan application or repayment process.

Conclusion:

The app is a user-friendly and convenient tool for individuals seeking financial assistance in rural and semi-urban areas. With its easy loan application process and multiple loan options, users can find suitable financing solutions to meet their needs. The app's wide network coverage ensures accessibility and support, even in remote locations. By utilizing the playing tips provided, users can maximize the benefits of the app and make informed decisions when applying for loans. Download the app today to access financial support tailored to rural communities.