Go Cash - Online Loan App

| Package ID: | |

|---|---|

| Latest Version: | v1.1.1 |

| Latest update: | Aug 13, 2024 16:18:04 |

| Developer: | Overseas Pioneer |

| Requirements: | Android |

| Category: | Finance |

| Size: | 5.70 MB |

| Tags: | Photograph Photo Finance |

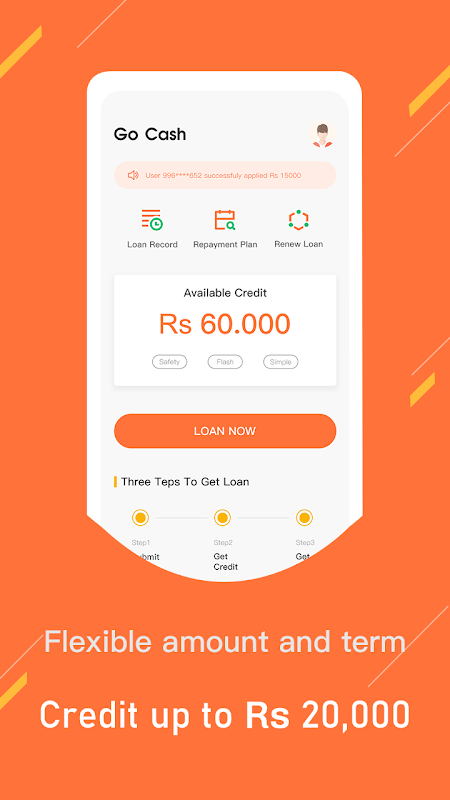

Introducing Go Cash - Online Loan App, the ultimate online loan app designed specifically for Indian users. With a wide range of loan options available, Go Cash provides high-quality credit loan services right at your fingertips. Whether you need a small loan of ₹2000 or a larger sum of ₹20000, we've got you covered. And the best part? You can choose your repayment period, whether it's on a weekly, fortnightly, or monthly basis. With a reducing annual interest rate of 21-27% and a yearly technology fee of just 3% of your approved credit limit, Go Cash ensures transparency and affordability. Plus, rest assured knowing that we work with trusted partners such as Hindusthan Microfinance Pvt. Ltd.-MFI and Sarwadi Finance Private Limited, ensuring that our policies and services are fully regulated and legally compliant. Get the financial assistance you need with Go Cash today!

Features of Go Cash - Online Loan App:

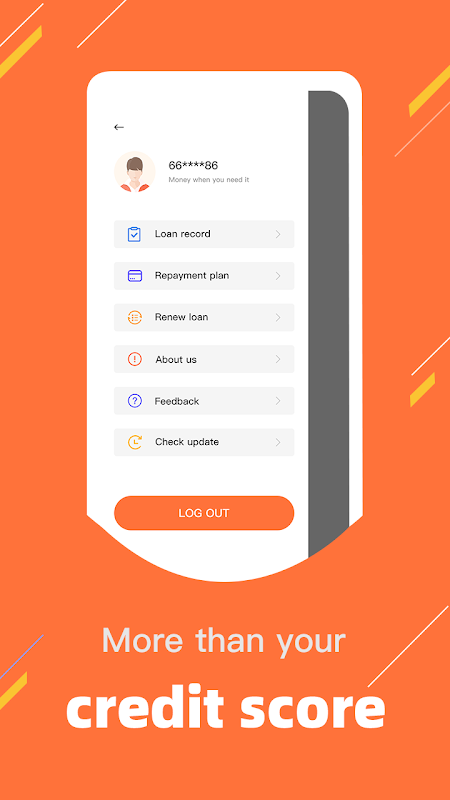

⭐ Convenient and Fast Loan Application Process: Go Cash offers a mobile online loan platform, allowing users to apply for loans conveniently and quickly using their smartphones. The app simplifies the loan application process and reduces the hassle traditionally associated with borrowing money.

⭐ Flexible Repayment Options: Users can choose from weekly, fortnightly, or monthly repayment options based on their preferred frequency and financial situation. This flexibility ensures that borrowers can repay their loans comfortably without putting excessive strain on their finances.

⭐ Competitive Interest Rates: With a reducing annual interest rate ranging from 21% to 27% compounded daily, Go Cash provides users with competitive rates compared to other loan providers. This allows borrowers to save on interest costs and make affordable loan repayments.

⭐ High Loan Amount Range: Go Cash offers loan amounts ranging from ₹2000 to ₹20000 providing users with the flexibility to borrow an amount that suits their financial needs. Whether it's for emergency expenses, home repairs, or personal investments, borrowers can access the funds they require.

FAQs:

⭐ How can I apply for a loan on Go Cash?

- To apply for a loan, simply download the Go Cash app on your mobile device, create an account, and complete the loan application form. Ensure that you provide accurate information to expedite the loan approval process.

⭐ Can I repay my loan before the scheduled repayment period?

- Yes, you have the option to repay your loan before the scheduled repayment period without any penalties. Early repayment can help you save on interest costs as you only pay interest for the actual duration of the loan.

⭐ What documents do I need to submit for loan approval?

- Go Cash requires minimal documentation. You will need to provide your identification proof, address proof, bank statements, and a recent photograph for loan approval.

Conclusion:

Go Cash - Online Loan App is a reliable and user-friendly online loan app that offers convenience, flexibility, and competitive interest rates to Indian users. With its easy application process, flexible repayment options, and high loan amount range, Go Cash aims to address the financial needs of individuals in a hassle-free manner. By partnering with trusted non-bank financial companies (NBFC) and banks, the app ensures the legality and regulatory compliance of its services. Whether you need immediate funds for emergencies or planned expenses, Go Cash provides a convenient and reliable solution. Download the app today to experience the benefits of accessible online credit loan services.