Introducing the Payday Loan APR Calculator, the quick and convenient solution for calculating the APR on your payday loans. If you're tired of doing the math or getting lost in complicated details, this app is here to help. With just a few taps, you can input the loan amount, loan fee, and loan term, and let the app work its magic. So why are payday loan APRs so high? It's because these loans are typically short-term, ranging from a week to just a few days. When calculated using the APR, the cost of the loan is assumed to be applied every 14 days, resulting in an inflated APR. But don't worry, the APR Calculator has got you covered. Give it a try and discover the APR of your payday loan today!

Features of Payday Loan APR Calculator:

❤ Quick and Easy APR Calculation: Our app provides a simple and efficient way to calculate the APR for payday loans without the need for manual calculations or extensive research. With just a few taps, you can get an accurate APR calculation instantly.

❤ Saves Time and Effort: Instead of spending valuable time manually calculating the APR for payday loans, our app streamlines the process, allowing you to get the information you need in seconds. This saves you time and effort, giving you more time to focus on other important tasks.

❤ Convenient and User-Friendly: Our app is designed to be user-friendly and convenient for all users. The intuitive interface allows even those with limited knowledge of financial calculations to easily navigate and use the app. You don't have to be a finance expert to understand and utilize the APR Calculator.

❤ Empowers Informed Decision-Making: By providing you with the APR calculation, our app empowers you to make informed decisions when it comes to payday loans. Knowing the APR helps you understand the true cost of borrowing and allows you to compare different loan offers to choose the most suitable one for your needs.

FAQs:

❤ Why is the APR for payday loans so high?

Payday loans are short-term loans usually lasting only a week or a few days. When the APR is calculated, it assumes that the cost of the loan would be applied every 14 days, as there are a little over 26 such periods in a year. This frequent application of the loan cost leads to a higher APR for payday loans.

❤ How to calculate the APR for a payday loan?

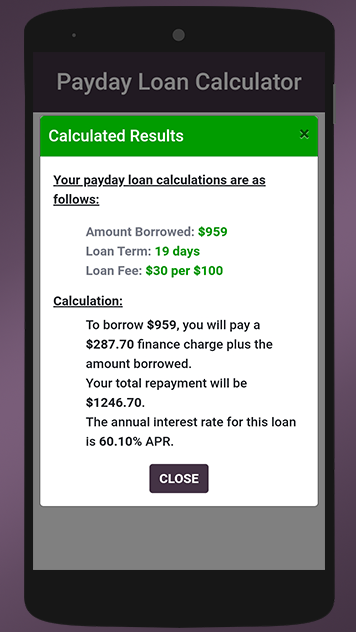

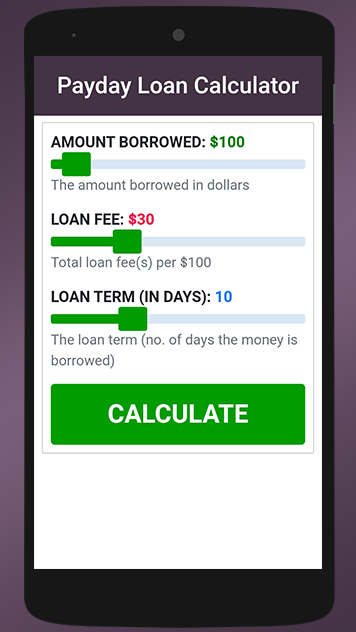

To calculate the APR using our app, simply input the loan amount in dollars, the loan fee also in dollars, and the loan term in days. Then tap on "Calculate" and the app will display the APR for that particular loan.

❤ Can I rely on the APR calculation provided by the app?

Yes, our app uses an accurate and reliable formula to calculate the APR for payday loans. However, it's important to note that the APR may vary based on the specific terms and conditions of the loan.

Conclusion:

Payday Loan APR Calculator offers a convenient and efficient way to calculate the APR for payday loans. By saving you time and effort, empowering you with accurate information, and providing a user-friendly interface, our app ensures that you can make informed decisions when it comes to borrowing. Understanding the true cost of borrowing through the APR allows you to choose the most suitable loan for your needs and avoid any unexpected financial burdens. Download our app now and take control of your payday loan decisions.